In recent days, there has been an electrifying buzz surrounding the emergence of e-Rupee, a pioneering government pilot project initiated by the National Payments Corporation of India (NPCI). As it coexists and collaborates seamlessly with the Unified Payments Interface (UPI) and traditional physical currency, e-Rupee is poised to reshape the future of financial transactions in India and beyond.

In this blog post, we delve into the captivating world of e-Rupee, exploring its potential, benefits, and the intriguing reasons behind its creation. Join us on this journey as we unravel the exciting future of this digital currency and shed light on the profound impact it may have on our lives.

What is e-Rupee?

e-Rupee is a digital payment solution launched by the Government of India in collaboration with the National Payments Corporation of India (NPCI). It is a prepaid voucher that can be used for various purposes such as healthcare, welfare schemes, etc.

It works on a QR code-based system and is designed to be a contactless payment solution. The voucher is sent to the user’s mobile phone through SMS, and the user can then show the SMS to the merchant to make the payment.

The impact of this on the Indian economy is significant. It is expected to boost financial inclusion, given the ease of use and accessibility for people who may not have access to traditional banking systems. Additionally, it can increase the efficiency of payment processes and reduce the risk of fraud. The launch of the e-Rupee is a milestone in India’s journey toward a cashless economy, and its potential for growth and innovation is immense.

How is it different from Cryptocurrency?

e-Rupee and cryptocurrency are both digital currencies, but they have some key differences.

- Centralization: Its a centralized digital currency, meaning that it is issued and regulated by a central authority, such as the Reserve Bank of India. Cryptocurrency, on the other hand, is a decentralized digital currency, meaning that it is not issued or regulated by any central authority.

- Security: Transactions are protected by digital encryption and other security measures, which makes them less vulnerable to fraud and other financial crimes. Cryptocurrency transactions, on the other hand, are not as well-protected, and they have been known to be vulnerable to fraud and other financial crimes.

- Use cases: Designed to be a more secure, convenient, and efficient way to make payments. Cryptocurrency, on the other hand, is often seen as an investment or a speculative asset.

- Regulation: Regulated by the Reserve Bank of India. Cryptocurrency, on the other hand, is not as well-regulated, and it is subject to different regulations in different countries.

- Denomination: Denomination and face values are fixed, unlike cryptocurrency whose face value is decided by exchange volume. RBI has a fixed denomination for each token and is completely controlled by the government.

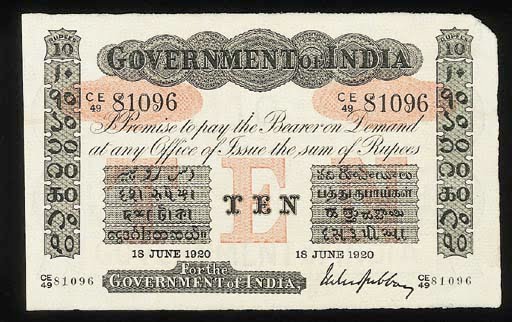

How e-Rupee and the physical Rupee would coexist?

The Reserve Bank of India (RBI) has said that e-rupee will be a complement to physical rupees, not a replacement. This means that both e-rupee and physical rupees will be legal tender in India.

There are a few reasons why e-rupee and physical rupees are likely to coexist. First, e-rupee is still in its early stages of development, and it is not yet clear how widely it will be adopted. Second, there are some use cases where physical rupees are still preferred, such as for small, everyday transactions. Third, the RBI may want to keep a certain level of physical cash in circulation in order to ensure financial stability.

Why e-Rupee?

E-Rupee holds revolutionary potential, not just for the urban areas but also for the rural areas. It can make digital transactions more accessible to those who do not have access to banking facilities. The unique fact about e-Rupee is that it is designed to be an e-voucher and does not require any Internet banking facilities.

E-Rupee’s role in achieving a cashless economy is undeniable. It reduces the cost of printing, distributing, and handling the physical currency, making transactions easier, more efficient, and more cost-effective. It is also fast and secure, ensuring less room for fraud and corruption.

- Improve the efficiency of the payments system: it can help to reduce the cost of processing payments and can make it easier for people to make payments, especially in rural areas.

- Promote financial inclusion: By making it easier for people to access digital payments, it can help to bring more people into the formal financial system.

- Improve the security of the payments system: By using digital encryption and other security measures, it can help to protect users from fraud and other financial crimes.

- Reduce the use of physical cash: E-rupee does not require the use of physical cash, which can help to reduce the environmental impact of the payments system.

- Provide a more convenient and user-friendly payment experience: it can be accessed through a variety of channels, making it easy to make payments anywhere, anytime.

Future of e-Rupee

The RBI has said that it plans to launch e-Rupee in a phased manner alongside cash+ saving accounts. The first phase will involve a pilot project with a limited number of users. The second phase will involve a wider rollout to more users. The RBI has not yet announced a timeline for the launch, but it is expected to be launched in the coming years.

E-rupee has the potential to revolutionize the payments landscape in India. It can make payments more secure, convenient, and efficient. It can also help to promote financial inclusion and economic growth. The RBI will need to address the challenges before it can be widely adopted, but the potential benefits are significant.

With its innovative approach and the ability to collaborate with other digital payment systems, it is well-positioned to be a powerful force in the global tech trends. Its impact on the world of digital payment solutions shouldn’t be underestimated, and it’s exciting to think about the possibilities.

As we look toward the future of digital payments, the E-Rupee is a shining example of what can be achieved through collaboration and innovation. Its development has the potential to be a game-changer for India and beyond.

Conclusion

In summary, E-Rupee is a revolutionary step towards a cashless India that offers ease of use, increased efficiency, and less room for fraud. Its potential for financial inclusion should not be underestimated, although concerns around privacy and implementation challenges require careful consideration. Despite this, the future of E-Rupee looks promising with potential for growth, innovation, and collaboration with other digital payment systems. It’s time to say goodbye to cash and embrace a digital economy with E-Rupee.

As we peer into the future, we envision a world where e-Rupee plays a pivotal role in driving financial inclusion, fostering economic growth, and unlocking new opportunities for individuals and businesses alike. We explore the potential benefits of e-Rupee, including reduced transaction costs, increased transparency, and a more inclusive financial ecosystem.

Read More about