Investors, always look for investment options, which are as safe as Fixed Deposits and yield returns that are off corporate bonds. Well, Treasury Bills, commonly known as T-Bills, are worth considering. T-Bills are short-term debt instruments issued by the Indian government to raise funds. This blog post will explore the features, benefits, and process of investing in T-Bills in India. Whether you’re a seasoned investor or a beginner looking for a safe investment avenue, this guide will provide the essential information to understand T-Bills and make informed investment decisions.

What are T-Bills?

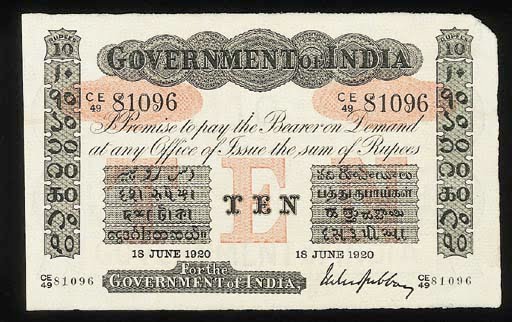

Treasury bills are money market instruments issued by the Government of India as promissory notes with guaranteed repayment at a later date. Funds collected through such tools are typically used to meet short-term requirements of the government, hence, to reduce the overall fiscal deficit of a country.

T-bills are offered for individual purchases at a discount from the total price. The investors can then profit from the disparity when they are redeemed for a minimum. T-bills are issued at zero-coupon rates, meaning no interest is accumulated.

As a result, it serves as an essential financial instrument for the Reserve Bank of India. It supports RBI’s efforts to regulate and manage overall cash flow in the market. We have already understood what are treasury bills. It is time to understand its types, advantages, disadvantages, the process of purchasing treasury bills, and much more. Let’s take a look at all these in detail.

Advantages Of Treasury Bills

Zero Risk: It is considered to carry either very little or no risk. In all likelihood, you will have your money returned along with the guaranteed interest.

Easily Convertible: They flow quite easily (i.e., you can easily convert them to cash). You always have the option to choose to get your money at any point, even before the entire period has passed. However, this is not advised unless you are in extreme financial necessity. Please be aware that you will not receive the entire amount promised if you choose to sell your T’bills before the period has expired to get your money. The investment will be discounted, to put it another way.

No Transaction Fee: There is no transaction fee. Brokers don’t charge you a fee for buying T’Bills for yourself, unlike other investment types, where the fee is assessed by the dealer who makes the transaction.

Limitations of Treasury Bill

Taxation: Short-term capital gain (STCG) realized on these bills is subject to STCG tax at rates applicable as per the income tax slab of an investor. Nonetheless, one major advantage of such G-Sec schemes is that retail investors are not required to pay any tax deducted at source (TDS) upon redemption of these bonds, thereby reducing the hassles of claiming back the same through income tax returns if he/she does not fall under the taxable income bracket.

Market Risk: Market risk for other kinds of government securities is the outcome of the negative movement of the assets’ prices as a consequence of changes in interest rates. Losses in value are the outcome. On the other hand, Treasury bills do not interest investors. They do provide assured returns from the sale of Treasury Bills.

Inflation: The returns you receive on Treasury Bills might be impacted by inflation. Your investing in government security may be useless, for instance, if the discount rate yields a return of 3% and the inflation rate is 5%.

Government Funding Requirements: The government issues Treasury bills to raise funds to meet short-term needs. As a result, the funding requirements and RBI’s financial policies impact T-bill pricing.

Types Of Treasury Bills

Treasury bills come in four different varieties. The holding time of these treasury bills serves as their primary distinguishing feature.

Treasury bill for 14 days

These bills reach maturity 14 days after the date of issuance. The payment is made the following Friday after the Wednesday auction. Every week there is an auction. The minimum investment amount for these bills is similarly Rs. 1 lakh, and they are offered in multiples of that amount.

1-year Treasury bill

These banknotes reach full maturity on the 91st day after the issuance date. They go up for auction each week. They are auctioned on Wednesday, and the money is paid the following Friday. The minimum deposit in such bills is similarly Rs. 25000, and they are offered in multiples of that amount.

Treasury bills for 182 days

182 days after the date of issuance are needed for these bills to mature. The funds are paid after the Wednesday auction on the subsequent Friday when the period expires. They are put up for auction every other week. The minimum investment in these bills is similarly Rs. 25000, and they are offered in multiples of that amount.

Treasury bills for 364 days

364 days after their issuance, these notes reach maturity. On the following Friday, when the term expires, the money is paid after the Wednesday auction. They are put up for auction every other week. The minimum investment in these bills is similarly Rs. 25000, sold in multiples of that amount.

Each banknote has a continuous holding period, as was already established. However, Treasury bills’ face value and discount rates are subject to cyclical adjustment. This depends on the RBI’s monetary policy, funding needs, and the overall contributions received.

The Reserve Bank of India also publishes a calendar for auctioning Treasury Bills. Before each auction, the precise date, the amount to be auctioned, and the maturity dates are announced.

Conclusion

During portfolio construction, alternative investment options provide diversification and T-Bills are one of the ways to invest in alternative investment options. T-Bills, provide adequate diversification and lower risk when compared to other available alternative investments. Investors looking for smaller ticket-size investment options and who have patience for the lock-in period should consider T-Bills.