Retirement. A variety of ideas come to mind when you hear this word, including travel, daily expenses, doctor visits, and so forth. It would help if you had a steady investment in some pension scheme like PPF, EPF, or NPS to last until the end because, post-retirement, you are unemployed or without a reliable source of income.

In addition to helping to create a retirement corpus or offering pension services, several schemes provide investment options. In addition to Public Provident Funds (PPF), Employee Provident Funds (EPF), Fixed Deposits (FD), and others, there is one more program focusing on retirement plans called the National Pension System (NPS).

National Pension System (NPS)

The Government of India-backed and PFRDA (Pension Fund Regulatory & Development Authority) controlled NPS is a distinctive pension program that offers both assets and deficit accessing a single investment and ensures a monthly pension after retirement.

NPS Eligibility

- All Indian citizens, whether they are residents or not, between the ages of 18 and 65, may participate. At 60, one can join the NPS and keep making payments until they are 70.

- Individuals should have their Aadhar card linked with their PAN number.

- Individuals should fulfill the KYC requirements as per the Subscriber Registration Form.

How NPS Works?

- Individuals with NPS accounts can contribute a minimum of Rs. 1000 per annum.

- PFRDA then pools the investments in a pension fund.

- PFRDA-approved fund managers then invest the funds in diversified portfolios of government bonds, corporate debts, and shares.

- The returns or interest rates offered by NPS vary according to market conditions.

- Upon retirement, the individual can withdraw a tax-free matured amount equal to approximately 60% of the investment.

- The remaining 40% must be invested in annuities, which generate monthly pensions through generated interest amounts.

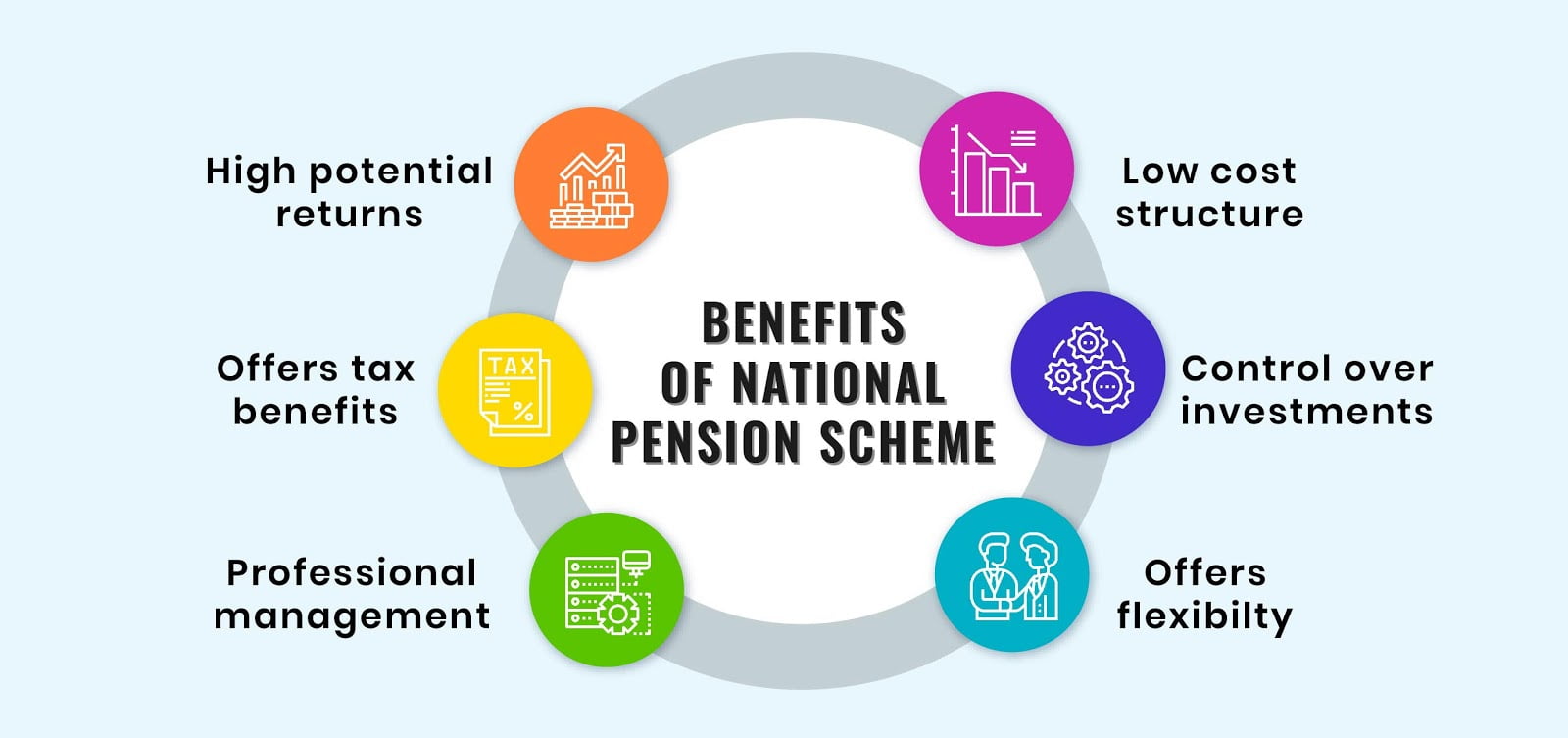

Features of NPS

- Low-cost scheme, requiring just a Rs. 1000 minimum yearly investment.

- Open program for all NRIs and citizens of India, ages 18 to 65, whether employed by any company or self-employed.

- Enables the choice of fund managers and investment strategies.

- The matured amount can be easily withdrawn after 60 years of age or withdrawn early after three years of investment.

- Enables fund diversification through asset classes, which are groups of assets based on the level of risk they involve.

- Using the dedicated NPS Portal, people can access their accounts from anywhere using a 12-digit Permanent Retirement Account Number (PRAN) card.

- Tax benefits of up to INR 2 lakhs for working individuals and a tax-free maturity amount upon retirement.

Tax Benefits of NPS

Section 80CCD (1)

The contribution made by a Government Sector Contributor (salaried) and a Non-Government Sector Contributor is described in Section 80CCD (1) of Section 80C. These contributions add up to 1.5 lakh INR. Salaried workers may deduct up to 10% of their salaries, while self-employed people may deduct up to 20% of their gross income.

Section 80CCD (1B)

Accompanying deduction of INR 50,000 for any additional self-contributions above Section 80CCD. Both salaried and self-employed individuals are subject to it and can avail of the benefit.

Section 80CCD (2)

Government and non-government employers’ contributions on behalf of their staff. A person may deduct the most is either the employer’s NPS contribution or 10% of their base salary plus Dearness Allowance (DA). Self-employed people are not eligible for this benefit.

Types of NPS account

- Each person must open the fundamental, required account to participate in the NPS scheme.

- The entire amount cannot be withdrawn before age 60, but under certain circumstances, you may withdraw up to 25% of the invested amount three times in a five-year period.

- You must open the account with at least INR 500, and there is a fee of INR 1000 per year.

- It is eligible for tax deductions of up to Rs. 1.5 lakh annually under Section 80C and an additional sum of up to Rs. 50,000 annually under Section 80CCD (1B).

- Sixty years of age allows for the tax-free withdrawal of 60% of the corpus.

- Annuities may be purchased with the remaining 40% of the maturity amount. It is possible to use the annuity’s interest as a pension, but it is taxed.

- Tier II

- The account is for retirement savings.

- Only those with active Tier I accounts are eligible to open it.

- Anytime is a good time to withdraw the money.

- After a three-year lock-in period, government workers are eligible to claim tax exemptions, but contributions are not tax deductible for the public.

Conclusion

It can be daunting to guesstimate the precise amount you’ll need to live comfortably during your retirement years. You can create the ideal retirement corpus that satisfies your financial needs by using NPS as a core retirement savings plan with some assets and supplementing it with other low-risk schemes that offer good returns and flexible liquidity.

FAQs

1. How to open an NPS Account?

To open an NPS Account, you would need to:

- Complete the NPS registration.

- Submit the necessary paperwork along with the Verification paperwork.

- Upon successful completion of your NPS login, the CRA will give you a PRAN (permanent retirement account number)

- The minimal account opening charge and the fund management fee must also be paid.