Sukanya Samriddhi Yojana is a saving scheme launched by the Government of India aimed at the betterment of girl child in the country. Sukanya Samriddhi Yojana is launched to provide a bright future for the girl child and enables parents to build a fund for the future education and marriage expenses of their girl child from a young age.

What is Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana was developed under the government’s ‘Beti Bachao, Beti Padhao’ initiative, it is a welfare scheme designed for the girl child. Investing in this child insurance plan allows their parents or legal guardians to ensure financial security for a girl child aged ten years or below. Under this scheme, an account in the name of the girl can be opened across any private and public sector banks for 21 years. The tenure of investment under the SSY scheme is 21 years, starting from the account’s opening date.

This deposit scheme can help you save regularly for your little girl. By making small to large deposits on a regular bases, you can create a sufficient corpus as the year’s pass. This corpus can be used to meet your girl child’s goals such as education, buying a home or even marriage.

How does Sukanya Samriddhi Yojana Account Work?

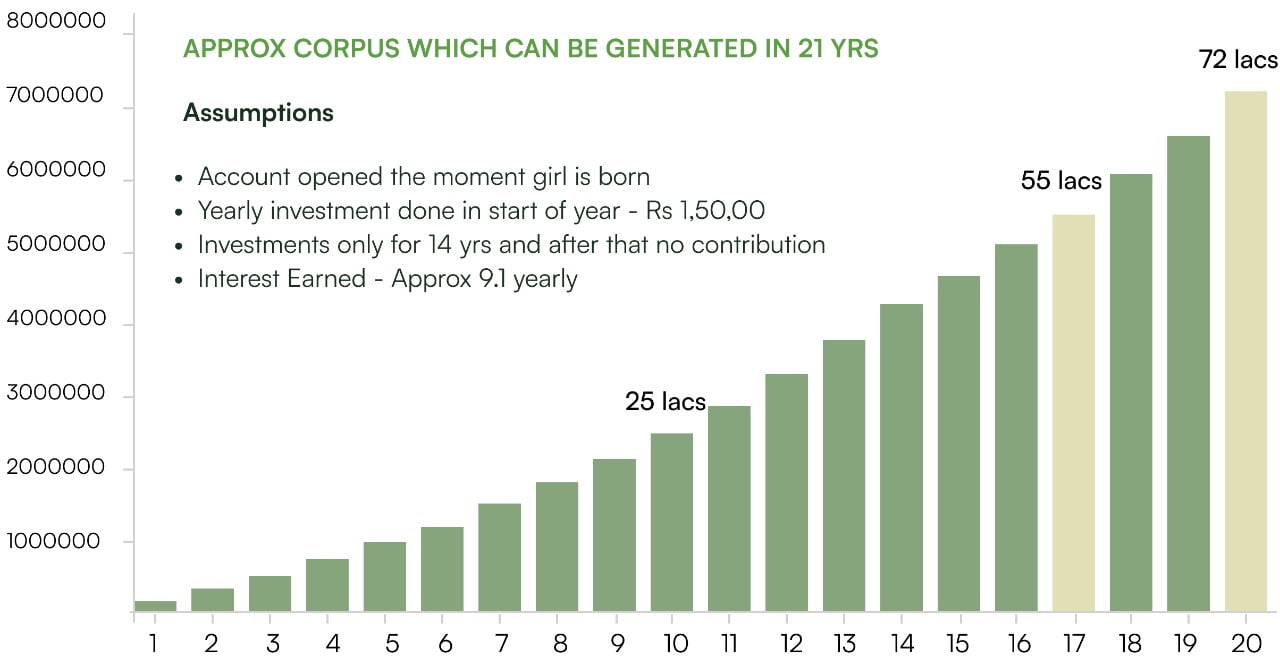

As parents, you can invest a minimum amount of Rs 1,000 and up to Rs 1.5 lakhs every year into your daughter’s account under this scheme. These deposits can be made only for the first 15 years after opening the account, after which no deposits can be made and the funds in the account would grow from the accumulated compound interest.

Subsequently, the accumulated amount can be withdrawn till the age of 21 years and can help your daughter support her dreams of higher education, starting a business or marriage, once she is no longer a minor.

Eligibility Criteria for Sukanya Samriddhi Yojana

The Government of India has made Sukanya Samriddhi Yojana accessible for the entire population of India, and hence, you can open an account at any post office nearest to you. The directive of the Sukanya Samriddhi Yojana is as follows :

- Only the parents or legitimate guardians of the girl child can open a Sukanya Samriddhi account.

- The girl child has to be under 10 years at the time of account opening.

- The account can be operational only till the girl child is 21 years old.

- The opening investment can begin from ₹250 with an deposit cap of ₹1,50,000 yearly with ongoing deposits in the products of ₹100.

- An individual girl child cannot have numerous Sukanya Samridhhi accounts.

- Only two Sukanya Samriddhi Yojana accounts are permitted per family.

Performance of the Sukanya Samriddhi Yojana

The interest rate on this scheme is fixed by the government and is reviewed by them every quarter. The Sukanya Samriddhi Yojana interest rate over the past few quarters are given below :

| Time Period | SSY Interest Rate (% annually) |

|---|---|

| Jan to Mar 2023 (Q4 FY 2022-23) | 7.6 |

| Oct to Dec 2022 (Q3 FY 2022-23) | 7.6 |

| Jul to Sep 2022 (Q2 FY 2022-23) | 7.6 |

| Apr to Jun 2022 (Q1 FY 2022-23) | 7.6 |

| Jan to Mar 2022 (Q4 FY 2021-22) | 7.6 |

| Oct to Dec 2021 (Q3 FY 2021-22) | 7.6 |

Benefits of Sukanya Samriddhi Yojana

- High Interest : A Sukanya Samriddhi Account provides a higher rate of interest than most other savings plan that offer financial security solely for the girl child. Each financial year, the government declares the new applicable interest rate for that year, which is compounded on a yearly basis. By maturity, the assets under your Sukanya Samriddhi Yojana account will increase manifold – thanks to the power of compounding. Here we have shown how an approximate corpus can be generated using the Sukanya Samriddhi Yojana calculator :

- Significant Tax Savings : Your investment/savings towards the Sukanya Samriddhi Yojana and the betterment of your daughter’s future are eligible for tax deductions under Section 80C of the Income Tax Act 1961. Thus, you can claim tax reductions of up to Rs 1.5 lakh invested in the scheme. Moreover, the tax-saving benefits are also available on the interest amount earned and the amount received upon maturity or withdrawals. The Sukanya Samriddhi Yojana scheme is under the authority of the Department of Revenue and is one of the more popular investment schemes that come with the exempt-exempt-exempt status.

- Guaranteed Maturity Benefits : Upon maturity, your entire account balance under the Sukanya Samriddhi Yojana, including the accumulated interest, will be paid directly to the policyholder. Thus, the scheme essentially assists your daughter to become financially independent and empowered once she is mature enough to make life decisions all by herself. Another benefit of investing under this scheme is that your accumulated savings continue to accrue compounding interest even after maturity up until it is finally closed by the account holder.

To conclude things

Sukanya Samriddhi Yojana provides one of the best possible investment opportunities for you to build up a sufficient corpus for your daughter when she turns 18 years old and is mature. The Sukanya Samriddhi Yojana comes with a sovereign guarantee, while its EEE status provides several benefits to both the parent and their little girl.