Pension is an important aspect of financial planning, particularly for individuals in the unorganized sector who do not have access to formal pension schemes. The Government of India has launched several pension schemes to provide social security to the people in the unorganized sector, and one such scheme is the Atal Pension Yojana (APY).

Launched in May 2015, the Atal Pension Yojana is a government-sponsored pension scheme that provides a regular pension income to workers in the unorganized sector. The scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) and is open to all Indian citizens between the ages of 18 and 40.

Features of Atal Pension Yojana

- Eligibility criteria:

- To be eligible for the Atal Pension Yojana, the subscriber must be an Indian citizen between the ages of 18 and 40. Since the contribution is made till the age of 60, it implies that the contribution period is 20 years or more.

- The scheme is open to all individuals who are not enrolled in any other formal pension scheme.

- The person should have a savings bank account or a post office savings bank account.

- The government has announced that from October 1, 2022, all income taxpayers are not eligible to apply for the Atal Pension Yojana (APY). This is to ensure that the scheme’s benefits go to the underprivileged.

- Contribution:

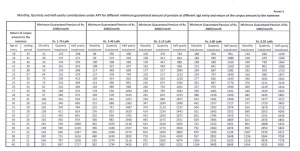

- The subscriber can choose the contribution amount, which depends on the pension amount they wish to receive.

- The minimum contribution amount varies from Rs. 42 to Rs. 1,454 per month, depending on the subscriber’s chosen pension amount.

- The contributions are made until the subscriber reaches the age of 60.

- Pension amount: The Atal Pension Yojana provides a guaranteed minimum pension of Rs. 1,000 to Rs. 5,000 per month, depending on the contribution amount and the age at which the person joins the scheme.

Source of the image

- Co-contribution by the government:

- The government provides a co-contribution of 50% of the subscriber’s contribution or Rs. 1,000 per year, whichever is lower, to eligible subscribers who join the scheme before December 31 2025.

- Only after the Central Record Keeping Agency receives confirmation that the subscriber has paid all the year’s instalments does the Pension Fund Regulatory and Development Authority (PFRDA) pay the government contribution to the eligible Permanent Retirement Account Number (PRANs).

- Nomination: The subscriber can nominate a nominee to receive the pension in case of their death.

Advantages of Atal Pension Yojana

- Social security: The Atal Pension Yojana provides social security to workers in the unorganized sector who do not have access to formal pension schemes

- Guaranteed pension: The scheme provides a guaranteed minimum pension, which ensures a regular income for subscribers during their retirement.

- Affordable contributions: The contribution amounts are affordable and vary based on the pension amount chosen by the subscriber.

- Co-contribution by the government: The government provides a co-contribution of 50% of the subscriber’s contribution or Rs. 1,000 per year, whichever is lower, which helps build a larger corpus for the subscriber.

- Tax benefits: The contributions made towards the Atal Pension Yojana are eligible for tax benefits under Section 80CCD of the Income Tax Act.

How to apply for Atal Pension Yojana

The Atal Pension Yojana can be applied online or offline. To apply for the scheme online, the subscriber can visit the scheme’s official website and fill in the online application form. To apply for the scheme offline, the subscriber can visit the nearest bank or post office and fill in the application form.

Documents required for Atal Pension Yojana

The following documents are required to apply for the Atal Pension Yojana:

- Aadhaar card or a proof of identity and address

- Savings bank account details

- Mobile number

Note: The subscriber is also required to provide the nominee’s details.

Withdrawal Rules of Atal Pension Yojana

- On attaining the age of 60 years:

- After 60 years, subscribers will request the guaranteed minimum monthly pension or a greater pension if investment returns exceed the guaranteed returns included in APY from the associated bank.

- After death, the spouse (default nominee) receives a similar monthly pension.

- After the subscriber and spouse die, the nominee will get pension funds accrued until age 60.

- Exit before the age of 60 years:

- In accordance with NPS rules for a pre-mature exit, PFRDA may allow exit before 60 in extraordinary situations, such as beneficiary death or terminal illness.

- If a subscriber who has received Government co-contribution leaves APY voluntarily, they will only be repaid their payments and the net actual accrued income on them (after deducting the account maintenance charges). Subscribers will not receive the Government co-contribution and its accrued income.

- Death of the subscriber before 60 years of age: The spouse or nominee will receive a full refund of the accumulated corpus under APY. However, the spouse or nominee will not be entitled to a pension.

Terms of Penalty in Atal Pension Yojana

The following penalty penalties are applied if the recipient delays paying contributions:

- 1 for monthly contributions of up to Rs. 100.

- 2 for monthly contributions within Rs. 101 and Rs. 500.

- 5 for monthly contributions within Rs. 501 and Rs. 1000.

- 10 for monthly contributions of Rs. 1001 and above.

The account will be frozen if payment defaults for six consecutive months. If this continues for twelve consecutive months, the account will be deactivated, and the amount accumulated and interest will be returned to the respective individual.

Conclusion

The Atal Pension Yojana is a simple and effective scheme that provides social security to millions of workers in the unorganized sector. The scheme offers a guaranteed minimum pension, affordable contributions, and tax benefits, making it an attractive option for individuals wishing to secure their financial future during retirement. With the growing awareness about the importance of financial planning and retirement, the scheme is likely to attract more subscribers in the future.