Compounding is the process in which an asset’s profits, from either equity gains or interest, are reinvested to generate additional earnings over a given period time. This growth, calculated using an exponential function, occurs because the investment will generate earnings from both its initial amount and the accumulated earnings from preceding periods.

Understanding Compounding

Compounding usually refers to the increasing value of an asset due to the interest earned on both a principal and accumulated interest. Compounding is absolutely crucial in the world of finance, and the gains attributable to its effects are the backbone to many investing strategies.

For example, a very common practice is to reinvest cash dividends earned from equity investments to purchase additional shares of the same stock. Reinvesting in dividend paying stocks compounds the return on investment because the increased amount of shares will consistently increase future income from dividend payouts, assuming the stocks pays out steady dividends on a regular basis.

Investing in such dividend growth stocks on top of reinvesting dividends adds another layer of compounding to this strategy that many investors refer to as double compounding. In this case, not only are dividends being reinvested to buy more shares, but these dividend growth stocks are also increasing the per-share payouts.

Power of Compounding

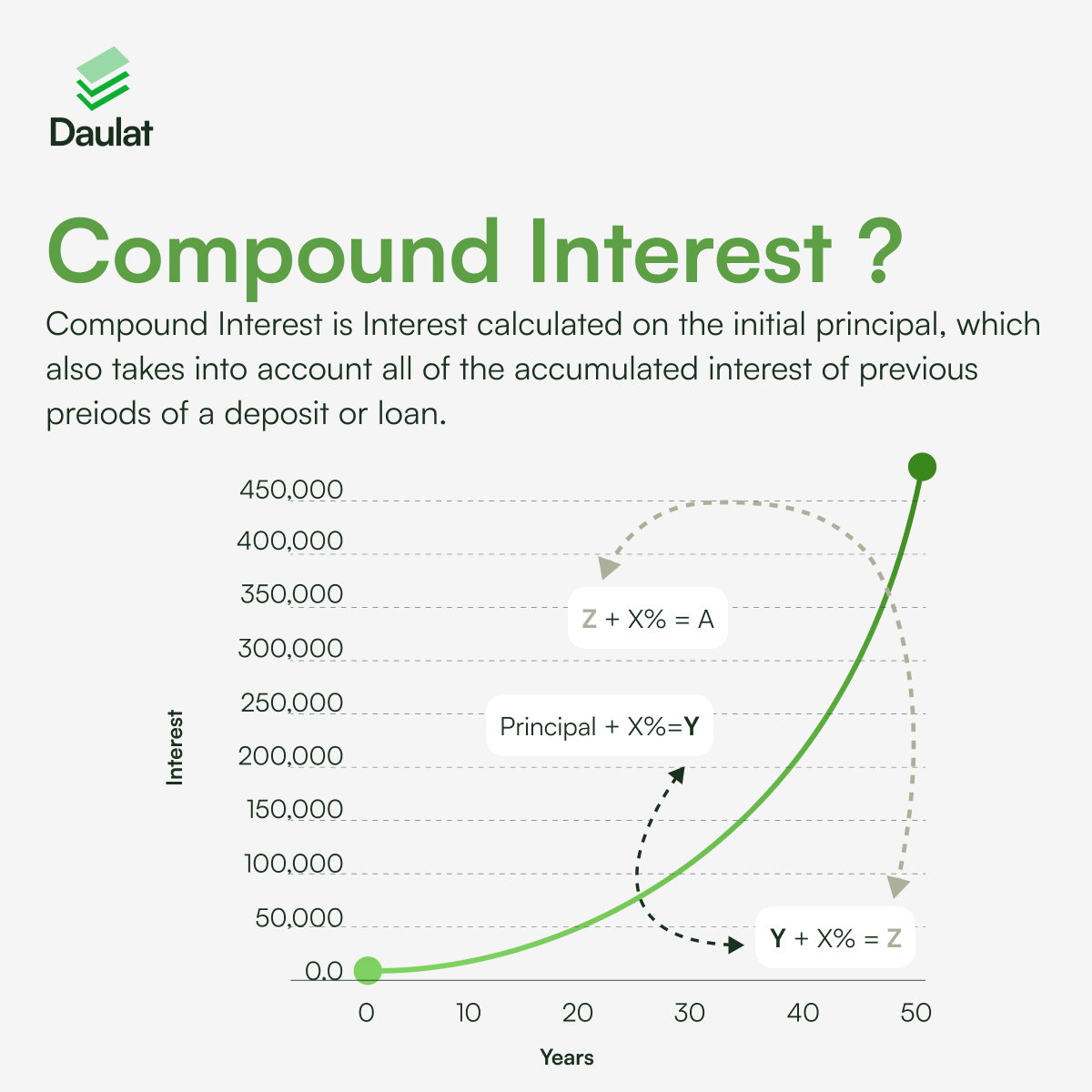

Compound interest includes interest accumulated during previous periods thus the investment grows at an ever increasing rate. Power of compounding enables your earnings to grow while your investments grow. Here’s how you can understand this better :

An interest is added on the initial investment amount, this interest is the compound interest. Since the amount would be added to your initial investment amount and the new interest is calculated on this new amount, the investment will continue to grow as this process would be consistent all throughout the period of investment.

The effects of compounding strengthens as the frequency of compounding increases. Assume a one-year time period. The more compounding takes place throughout this one year, the higher the future value of the investment will be, so naturally, three compounding periods per year are better than two, and four compounding periods per year are better than three. To illustrate this effect, lets take an example and calculate the compound interest for Rs.10,000 and see what happens to it over 10 years with varying compounding frequencies :

| Compounding done every year | Investment Amount | Compounded Amount |

|---|---|---|

| 1 | 10,000 | 15,937 |

| 2 | 10,000 | 16,533 |

| 4 | 10,000 | 16,851 |

| 12 | 10,000 | 17,070 |

Compounding – The boons and banes

Compound interest works on both investments and liabilities. While compounding can boost the value of an asset very rapidly, it can also increase the amount of money owed on a debt, as interest accumulates on the unpaid principal amount and previous interest charges. Even if you make loan payments, compounding interest may result in the amount of money you owe being greater in the future.

The concept of compounding is especially problematic for credit card debts. Not only is the interest rate on credit card debts very high, the interest charges may be added to the principal balance and incur an interest assessment on itself in the future. For this reason, the concept of compounding is not necessarily per say “good” or “bad”. The effects of compounding may work in favor of or against an investor depending on their specific financial situation and what they do with their money.

Compound interest and the effect of time

Many young individuals take the combination of time and compounding very lightly. For people in their 20s and 30s the future seems so far ahead, yet these are the years when compound interest can be a game-changer. Investing small amounts from a young age can be much more profitable than investing large amounts later in life.

Allowing your investments to mature while compounding at the same time can create huge profits and increase your money dramatically.

In Conclusion

The long-term effect of compound interest on your savings and investments is indeed miraculous in nature. Because it grows your money much faster than simple interest, it is a very central factor in increasing wealth. It also mitigates a rising cost of living caused by inflation, as it will almost certainly outpace it and grow your money dramatically.

For young people especially, compound interest is a godsend, as they have the most time ahead of them in which to save and invest.