Understanding where to invest and earning considerable profits can be daunting and also requires a learning curve. In this article, we go over 7 lessons that will help novice investors to not only invest better and maximize profits, but also help you minimize your losses.

Lesson 1 : Diversification is key

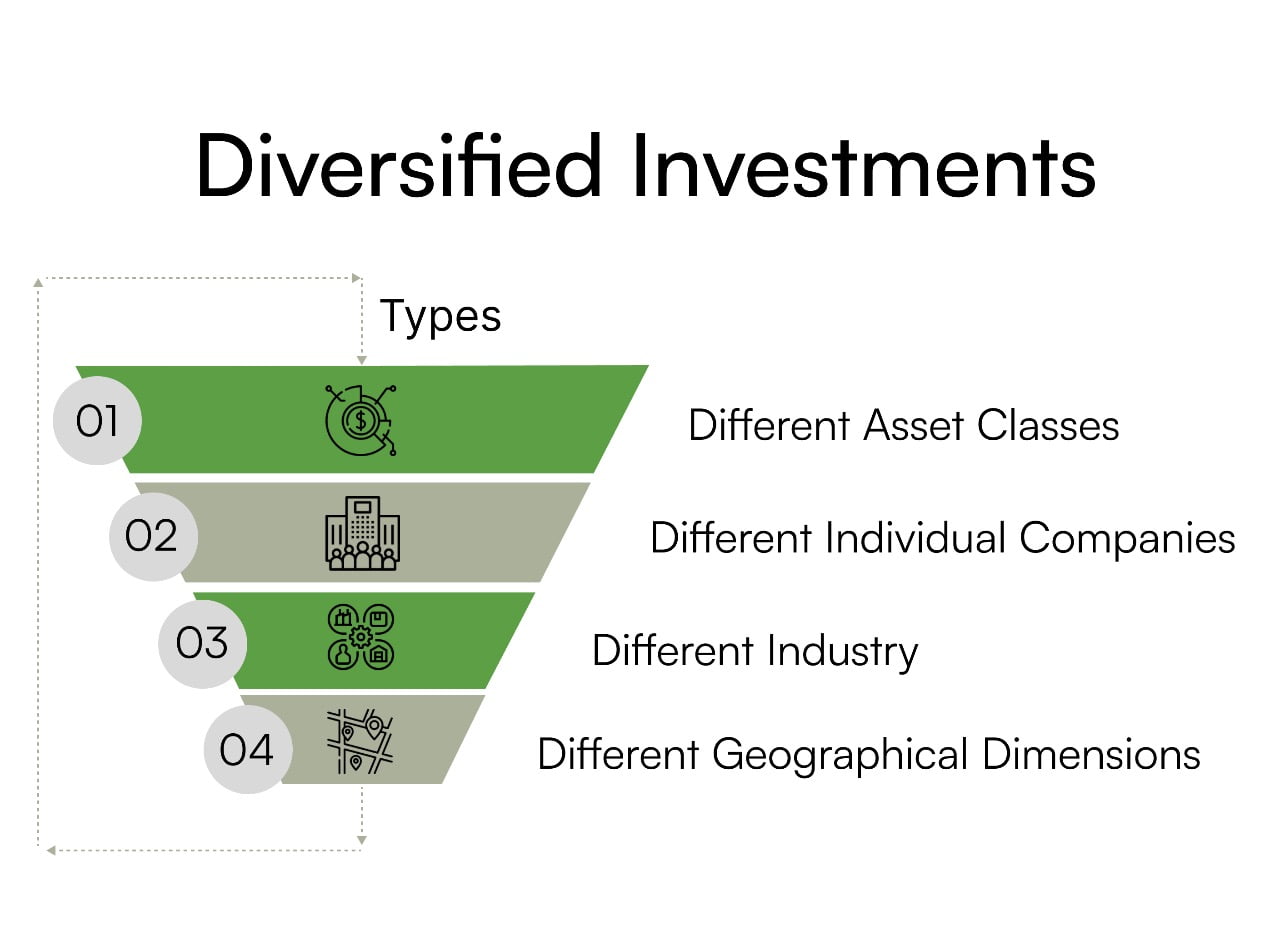

One major mistake that novice investors make when they start their journey is that they concentrate their assets in a single form of investment. Diversification not only means investing in different stocks or investing in a single industry but also the allocation of assets in different asset classes such as, equities, mutual funds, bonds, real estate, etc. But it is also important to understand that too much diversification is also a problem because investing in multiple assets with a limited asset pool will not allow you too reap significant rewards.

Lesson 2 : Keep your emotions in check

Investing your hard earned money is a rather stressful process for not only novice investors but all investors which can lead to you trusting your emotions rather than your mind and emotionally invest. Emotional investing is an investing strategy where you make decisions based on markets’ daily gyrations and what you think of them rather than fundamentals. It constitutes of letting fear, greed, anxiety, and optimism get the better of you. This type of investment is based on an investor’s behavioural and emotional impulses and is influenced by market trends. It is more of a cycle where investors react to market volatility and swings.

Lesson 3 : Consult a financial advisor

Engage with a financial advisor to better understand your situation and help you invest better. Expert advice can do wonders to a novice investor’s portfolio and help them see the big pictures. Financial advisors, who have years of experience, can help you navigate choppy waters and bullish markets with ease and ensure you do not indulge in impulsive trading or overestimate your risk tolerance.

It gives you the chance to re-evaluate your investment approach and better assess your risk appetite. It helps you be logical and make rational investment decisions to help your money grow.

Lesson 4 : Educate yourself financially

Financial literacy is a crucial life skill to possess, because it boosts your financial capability. Savings, budgeting, and financial planning should be taught to people at a young age. Without financial literacy, one’s actions and decisions about savings and investments would be quite weak and unsupported. One can manage their finances effectively by learning basic financial principles. Additionally, it facilitates good financial decision-making, financial management, and stability.

Lesson 5 : Avoid trying to time the market

The time you spend in the market is much more important than timing the market. Moreover, it is important for novice investors not to develop a trader or speculator’s mentality right of the bat. After all, this entire practice of timing the market based on news, opinions, tweets, interest rates, liquidity, and so on often does a lot more harm than simple rules based investments focusing fundamentals.

If you have not reached your long-term financial goal then canceling your SIPs and liquidating your assets is certainly not going to help you reach there any faster. Stay invested for the long game, as stock markets and individual stocks have reliable businesses behind them that are continually earning more and more profits over the long run.

Lesson 6 : Have a goal in mind

Goal based investing involves keeping a specific personal goal in mind while choosing the method to invest. Goals help investors stay on the course and keep investors disciplined as they can monitor and track their progress at regular intervals. A set of clear goals helps strategize and dramatically improve budgeting. As a result, investors deal with poor market movements better. Focusing on long-term goals, allows us to be less distracted by short-term volatility and noise.

This is a crucial advantage because not only do novice investors sometimes lose hope, but emotions can also drive them towards poor decisions. It will help us refrain from selling down our positions or changing our investment strategy to one that reduces our chances of reaching our financial goals, and instead focus on sticking to our designed investment plans.

Lesson 7 : Invest in companies with good fundamentals

Fundamentals of a company are usually its indexes, which are used to determine its financials and whether the investment price is able to justify itself through earnings and profit. Investments that are able to justify their price are called value investments.

Value investing involves a process through which investors unearth possible investment opportunities that are available at a lower price of what they’re actually worth. These investments are known as undervalued investments and they generally tend to possess a significantly high growth potential in the future. Value investments have very little downsides to them, a good example to explain this is stocks. With value stocks, the downside, if any, also tends to be lower since they’re already trading at a lower price point than their actual worth.