As a customer, you must have definitely experienced an increase in prices of various goods and services over a period of time. For example, petrol used to cost about ₹70-80 a litre, a few years back and today it costs more than ₹100 a litre. Similarly, you must have noticed an increase in the price of various other goods, such as vegetables, fruits, cars, phones and many more. This gradual increase in price is nothing but inflation.

If your investment returns are not able to beat inflation in the long run, it can jeopardize your chances of meeting your financial goals. Let’s take a deeper look into inflation and truly understand how it can affect our investments.

What is Inflation?

Inflation is the general trend of an increase in the price of various goods and services, on a year-on-year basis. A rise in inflation can also be associated with a decline in the purchasing power of the customer, over time. In simple terms, during inflation one will need more money to buy the same amount of goods and services the very next year.

For example, the bread used to cost ₹30 per loaf last year, while it costs ₹33 currently. This means, to buy the same loaf of bread you will have to pay 10% more than last year. It means the bread inflation is 10% on a year-to-year (Y-O-Y) basis.

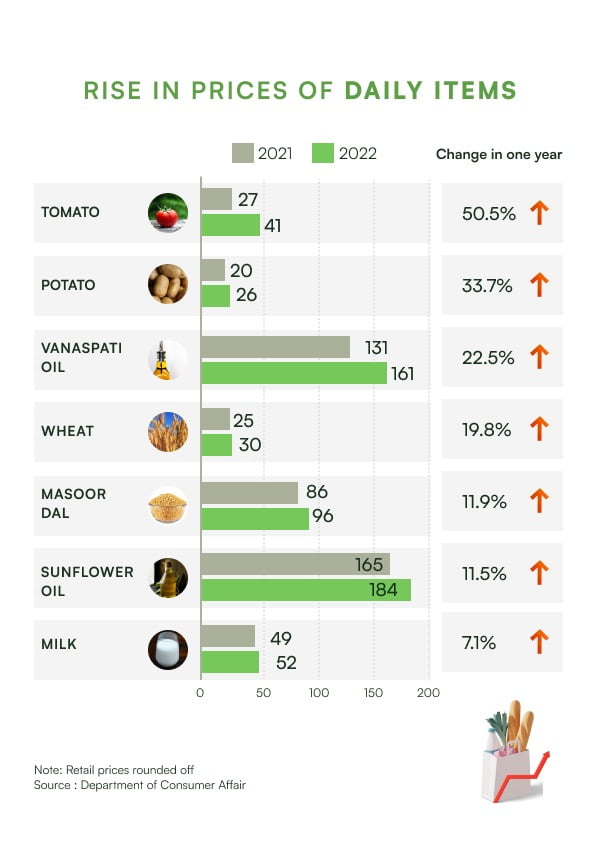

Take a look at the table above. It is clear that the prices of various food products have increased dramatically over the past year. This means that a person has to shell out more money in order to buy the same food products, the very next year. Hence, one needs to earn more money with every passing year or needs a higher return on their investments than inflation to sustain the same standard of living.

How does inflation affect your ROI?

Return on investments or ROI in short is an approximate measure of an investment’s profitability. As an investor, you must always consider your ROI after considering the effect of inflation. For example, as of today, the ICICI Bank 1-year fixed deposit pays a return of 6.10% per annum. In this case, if you put ₹10,000 in this fixed deposit, then at the end of 1 year the ₹10,000 will become ₹10,610. The September 2022 inflation rate based on Consumer Price Index (CPI) is 7.41%. This means that goods that took ₹10,000 to purchase last year, would now take ₹10,741 to obtain. So one has to put in an additional ₹131 to maintain the same standard of living.

Just like in the above example, when the inflation rates are higher than the current ROI, rather than making money you lose money. This is because you had to pay money from your own pocket to sustain the same standard of living as last year. In conclusion, high inflation can easily erode the purchasing power of your money.

How can inflation affect your financial goals?

One of the most common mistake that investors make when planning their investments is not accounting for inflation. If your ROI is not able to beat inflation in the long run, it can hamper the chances of you meeting your financial goals. Let’s take a look at this, with the help of an example. As explained above, the value of ₹10,000 will change over time with the rate of inflation. Let’s say that the rate of inflation is 6%, then you will need to save an additional 6% to ensure that your savings can be sufficient to help you achieve all your long-term financial goals like your dream house, your child’s education, your retirement and much more.

Hence, you should plan for the effects of inflation and start investing your money in financial instruments that can offer you higher returns to counter the effects of inflation.

Let’s say that the average monthly expense for your family is about ₹1,00,000 as of today. The table below can be used to understand how can inflation affect your monthly expenditure :

| Year | Expense Amount |

|---|---|

| Start Year | ₹1,00,000/- |

| 10th Year | ₹1,68,948/- |

| 20th Year | ₹3,02,560/- |

Now, let’s see how are your savings affected by the same inflation rate as above :

| Year | Expense Amount |

|---|---|

| Start Year | ₹1,00,000/- |

| 10th Year | ₹57,299/- |

| 20th Year | ₹30,862/- |

You can see that the number of expenses will continue to increase, while the value of your savings will keep decreasing over time. This makes it all the more important, that you should consider inflation while planning the structure of your portfolio. Thus, you should start investing your money in financial instruments that can offer you higher returns to counter the effects of inflation.

How to counter inflation?

There are various strategies that can be implemented to plan for inflation. Some of these strategies have been listed below:

- Create a strong investment strategy: A strong investment strategy can be a major building block for your future savings. A sound approach to investing can help you tackle inflation and ensure adequate savings that stand the test of time.

- Add inflation-proof investments to your portfolio: Investments that offer returns that can counter the ill effects of inflation will certainly help you tackle the rising prices. Hence, you should look for investments that offer you inflation appropriate i.e high returns. A good example of this is equity mutual funds. Equity Mutual Funds park their major investments in equity and equity-related instruments in an attempt to get you higher returns and thus being one of the riskier forms of all the available mutual fund schemes in the market.

- Diversify your investment pool: While traditional saving instruments might offer you secured returns and ease of accessibility, they may not be sufficient to keep up with the changing times and rising prices. You must diversify your portfolio and ensure that your money is efficiently invested for the long term in market-linked instruments. This will offer you higher returns as well as the ability to combat inflation.

- Consider the taxation: It is really important to understand the post-tax returns of various instruments to understand the true rate of return. For e.g. Traditional options like bank FDs may look very appealing but their post-tax returns are often lower than the inflation rate. Debt mutual funds on the other hand offer a significantly higher post-tax return for investors.

In conclusion

Inflation can be a hindrance to your savings funds if you do not account for it correctly. Therefore, you can invest in diversified inflation-proof opportunities to get high returns, which will subsequently help you combat the inflated rates. Before you invest or save for your tomorrow, make sure to also calculate how inflation is likely to affect you and your future standard of living.