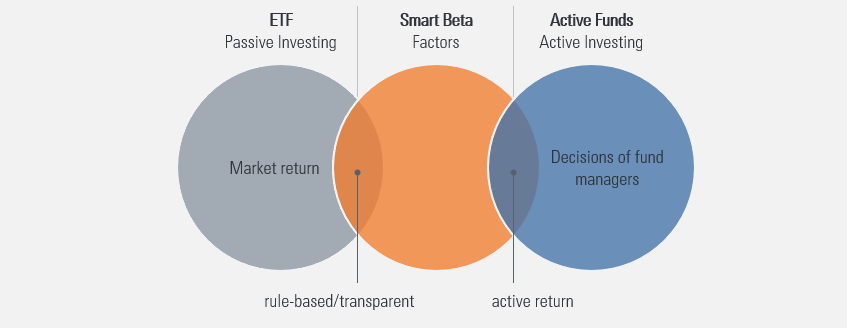

Investors have historically had the option of allocating their money between active and passive management strategies when investing in public markets. A broad-based, cap-weighted, passive exposure to stocks, bonds, or commodities is available at a low cost (total expense ratio), or you can choose from several active managers at a greater price who offer a variety of styles, strategies, and market segments. After the introduction of smart beta funds in 2003, this changed.

The meaning of Smart Beta Funds

Similar to passive investments like standard exchange-traded funds (ETFs) and index funds, smart beta funds—also known as strategic-beta funds or factor-based funds—track the benchmark indexes. The distinction is that smart-beta funds choose equities using factors rather than weighting assets according to market capitalization.

What is a Smart Beta Strategy?

Smart beta funds choose their underlying investments based on a variety of criteria, including low volatility (lower variation in price movement), momentum (following the trend), quality (buying businesses with sustainable earnings and little or no debt), size (smaller businesses), dividend growth, share buyback, cash flow, book value, etc. Given that value plays a significant role in smart beta strategies, even though everything sounds exotic, we can trace this so-called factor investing back to Benjamin Graham.

The goal is to raise the return offered by traditionally constructed stock indices based on market capitalization. It tries to introduce active rule-based management while eliminating the role of emotions in choosing investments. These tactics are sought after by investors looking to outperform the market.

How do smart beta funds work?

Smart beta funds purchase an index like the Sensex, but money is distributed among the index’s stocks according to the abovementioned factors.

These investment funds vary in how they base their decisions—some are driven by just one element, while others by two or more. The latter are frequently known as multi-factor funds. Before being implemented in the real world for investment purposes, the index built on these parameters is back-tested for return. Given the pitifully low-interest rates in the developed world, investors have been paying close attention to a smart beta fund focused on dividend yield.

Smart Beta funds in India

Due to increased flows from the National Pension Fund (NPF) and Employee’s Provident Funds (EPF), which have been using ETFs to direct their funds in stocks, passive investing has gained popularity among investors over the past three years. According to data from the Association of Mutual Funds of India (AMFI), as of the end of August 2020, passive funds, including exchange-traded funds (ETFs) and index funds, had assets under management (AUM) of 2.19 lakh crores and had received inflows of INR 70,773 crores during the previous year.

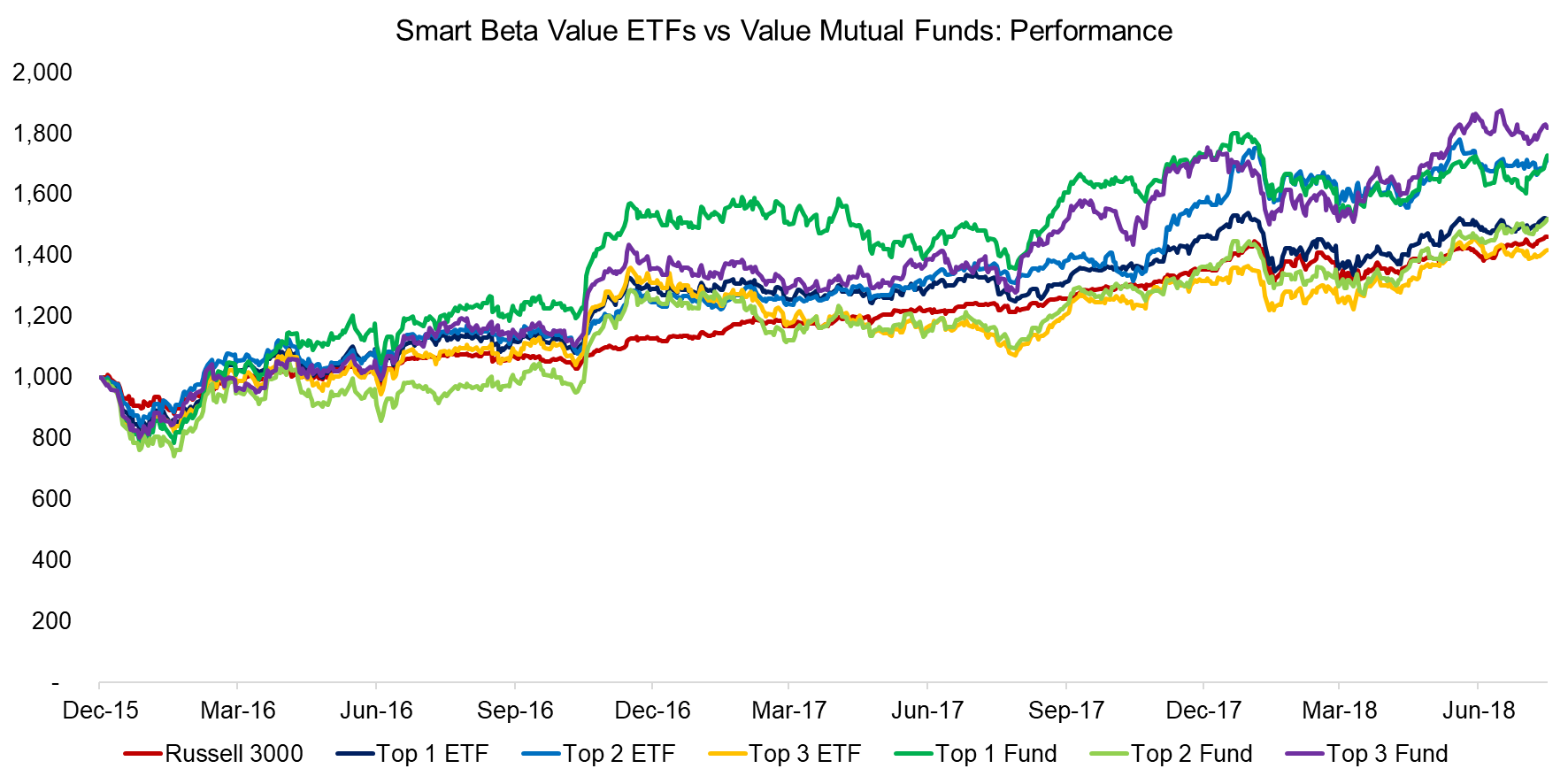

The main determining factor for smart beta funds in India is style. Taking the value-based smart-beta funds as an example. Over the past year, these value-based Smart beta ETFs have beaten their large-cap counterparts by an average of more than 2.5%. Despite having the same benchmark index, tracking mistakes, liquidity issues, and various expense ratios can cause smart beta ETF returns to diverge.

Issues with Smart Beta Funds

- The trading volumes in these smart-beta funds may be low because this investing approach is still relatively new, which impacts liquidity and, in turn, the ability of investors to sell their portfolios at the current market value.

- While investing in these complex investment vehicles, investors must consider several factors. Investors may need clarification as a result of this.

- Smart beta ETFs are more expensive, hazardous, and prone to protracted periods of underperformance than conventional ETFs. Additionally, they have a higher cost of rebalancing, expense ratio, and portfolio turnover.

Should you make a smart beta fund investment?

As indicated above, these funds weigh equities according to objective variables rather than the market cap. In essence, these are made to outperform the benchmark while maintaining costs below those of actively managed alternatives.

Smart-beta funds can diversify your entire portfolio and reduce some of the stock market’s volatility. An investor must realize that a fund ceases to be passive if it departs from the market capitalization theory.

In addition, compared to conventional ETFs and index funds, they are more expensive and frequently display a prolonged period of underperformance. Investors who are considering investing in these funds should exercise care.

Market participants who participate in actively managed funds may designate a limited portion of their investable surplus to this category.

Conclusion

Smart beta is just a marketing term. There is no smart beta or dumb beta. In contrast to the Nifty 50, market capitalization-weighted, smart beta funds are nothing more than factor funds or funds with alternatively weighted indexes. Factor fund performance in real-time may vary from index performance. Factors can be very cyclical and underperform index funds or simple diversified funds for decades. The importance of factor diversity is a key issue to consider if you wish to invest in factor funds. It is extremely dangerous to base investments on a factor’s prior performance.