In 1993, the first Exchange Traded Funds (ETFs) were introduced in the USA. Since then, they have become increasingly well-known worldwide, not just in America. The first ETF to be introduced in India was Nifty BeEs in 2002. It has increased since then by 1914.15%. (absolute returns). Nifty BeEs follow the “Nifty” benchmark index. Stocks and mutual funds are familiar concepts to many investors. However, the investor community needs to be more knowledgeable about Exchange Traded Funds.

In this blog, we’ll provide you with an introduction to Exchange Traded Funds.

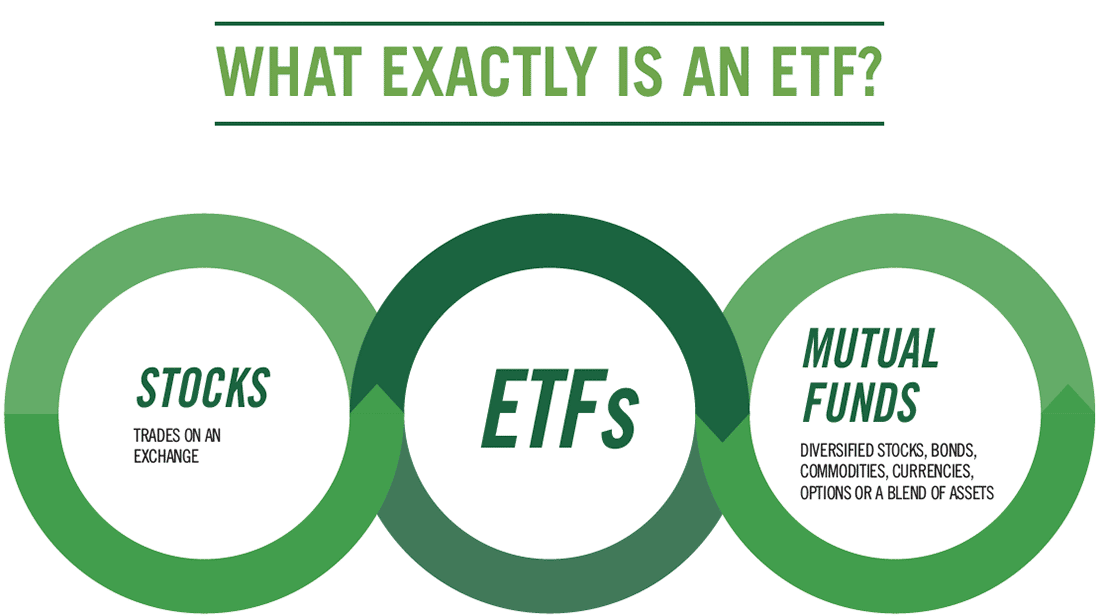

What is an ETF?

A mutual fund with a few minor differences is an ETF. An ETF gathers money from investors, has a fund manager, and will have a NAV, just like a mutual fund (net asset value). However, the two characteristics described below set them apart from standard mutual funds. As follows:

- Regular mutual funds are not traded on the stock exchange, but ETFs are.

- Exchange Traded Funds are passive mutual funds that typically track prestigious indices like the Sensex or the Nifty.

The fund managers of Exchange Traded Funds make sure that the returns of the ETFs closely resemble the returns of the benchmark indices by purchasing equities that make up those indices.

Exchange Traded Funds are listed on stock exchanges, just like stocks are. Using their stockbrokers, investors can trade or invest in them.

How is an ETF operated?

When you purchase a mutual fund, the AMC receives your money, buys the securities, and announces the NAV at the end of the day. Similarly, AMC sells the securities and refunds your money when you redeem your mutual funds. This is a really simple matter. However, because most buying and selling occurs on stock markets, you rarely deal with the AMC when you purchase an ETF. Just a simple unit transaction between buyers and sellers.

Exchange Traded Fund Categories

Exchange traded funds are separated into four groups. As follows:

Equity ETF

These ETFs attempt to follow the performance of stock indices or a collection of equities from a certain sector or industry. These ETFs aim to replicate the performance of their respective sector or benchmark index.

Gold ETFs

Investing in gold is an effective approach to safeguard against currency fluctuations and economic downturns. On the other hand, real gold investment has several disadvantages, including security, quality, resale, and taxation. Exchange-traded funds, or gold ETFs, enable investors to include gold in their portfolios without buying physical gold. Gold ETFs invest in gold bullion.

ETFs with International Exposure

Certain Exchange traded funds imitate the performance of international stock indices. They give investors access to global markets and allow them to participate in particular economies’ success stories.

Debt ETFs

Debt ETFs can be used to buy fixed-income securities. On the NSE, these are traded often. Debt mutual funds are more expensive than debt exchange-traded funds (ETFs).

Benefits of Exchange Traded Funds

A fantastic way to diversify your stock assets is with an ETF. Based on the size of your investment portfolio, you can only buy a limited number of stocks when you invest in stocks.

Choosing the right supplies becomes crucial as a result. The exposure to a wider variety of assets you gain by investing in an ETF that tracks a sector or asset class, however, diversifies and improves your portfolio. The following are some benefits of ETFs:

- ETFs can be easily exchanged on stock markets, just like shares.

- Exchanges of ETF units take place at market rates. Therefore, you may profit if market perception favors the industry or market that the ETF tracks.

- Units can be bought and sold at any time of day.

- An ETF’s expense ratio is often lower than most conventional mutual funds (especially actively managed mutual funds).

How to Select an ETF for Yourself?

Before making an ETF investment, there are four things to look into. As follows:

Category of ETF

The different types are equity, gold, international exposure ETFs, and debt. The industry in which you intend to invest deserves research. Find the subcategories after choosing the category. For instance, the subcategories for equities would be based on capitalization, industries, etc., if you were to invest in the equity ETF category.

Trading Volume of ETFs

Investors in ETFs had liquidity problems in the past. But today, things have changed. Due to the increased popularity of Exchange traded funds and their high levels of liquidity, buying and selling ETF units has become simpler. A few ETFs do, however, have lower trading volumes than others. Due to a lack of liquidity, it may be challenging to sell your current units or purchase new ones in such ETFs. Therefore, always select an ETF with a healthy trading volume.

Expense Ratio

The expense ratio may reduce your returns. It would help if you chose an ETF with a lower expense ratio than its competitors to earn better returns.

Tracking Error

These are frequently developed to follow a specific index. They invest in index-related securities so that the returns “closely match” the indices. The returns of the index and the ETF always differ from one another as a result. Make sure to pick an ETF with a small tracking inaccuracy.

Conclusion

- ETFs are comparable to conventional mutual funds but can be exchanged on stock exchanges.

- ETFs are actively managed passive products with lower expense ratios than traditional mutual funds.

- ETFs often follow a benchmark index or a specific industry.