Before we explain the concept of Sequence of Returns risk, let’s first quickly take a recap of the two broad categories of investors that exist in the market: a) Buy-and-hold investors: If you invest either a lump sum or make regular contributions through a SIP and do not intend to withdraw any money in the interim – you are a buy-and-hold investor. b) Withdraw investments periodically: If you are in retirement or would like to withdraw a certain portion of your investments regularly. We talked about retirement planning in our earlier post.

Both of these investors are affected differently by the movements in the markets. While the former is more concerned with the average return generated by the investments over a period of time, the former is bothered about the timing of those returns and the sequence in which they occur.

The sequence of Returns risk is the risk that the withdrawals from your portfolio will coincide with a ‘sequence’ of negative investment returns in the markets causing permanent damage to your retirement portfolio. This is because, in the absence of regular additions to your portfolio, you are essentially withdrawing from a reducing-balance account that will take a lot longer to recover from the depths. Sounds confusing? The graphs below will make it easy for you to visualise this.

How it affects your investments?

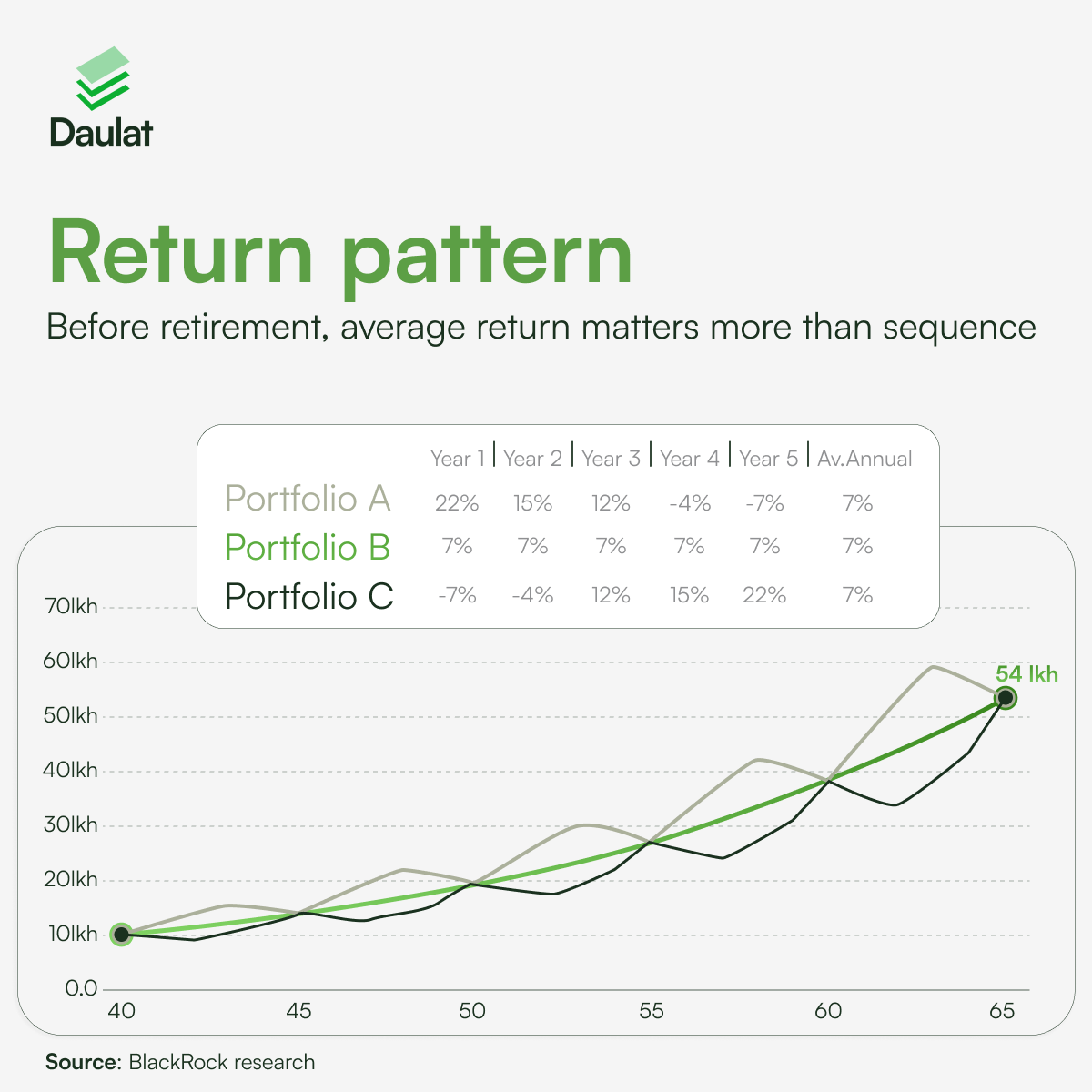

Let’s understand that with a graphical illustration:

An individual investing INR 10 lakhs as a lumpsum investment when he is 40 years old will see his investment value rise to INR54 lakhs in 25 years assuming an average return of 7%. The ‘sequence’ of the investment returns does not matter as long as the investor continues to hold the investment and has no interim withdrawals.

When we invest, we often tend to put too much focus on whether we are buying/selling low/high respectively – however, over a period of time, as we can see the outcome is the same. Therefore, if you are in the accumulation phase of your life and are investing towards building a corpus for your retirement – you shouldn’t be too worried about the day-to-day or in fact even year-to-year returns of your investment. What matters is the average compunded returns over the period.

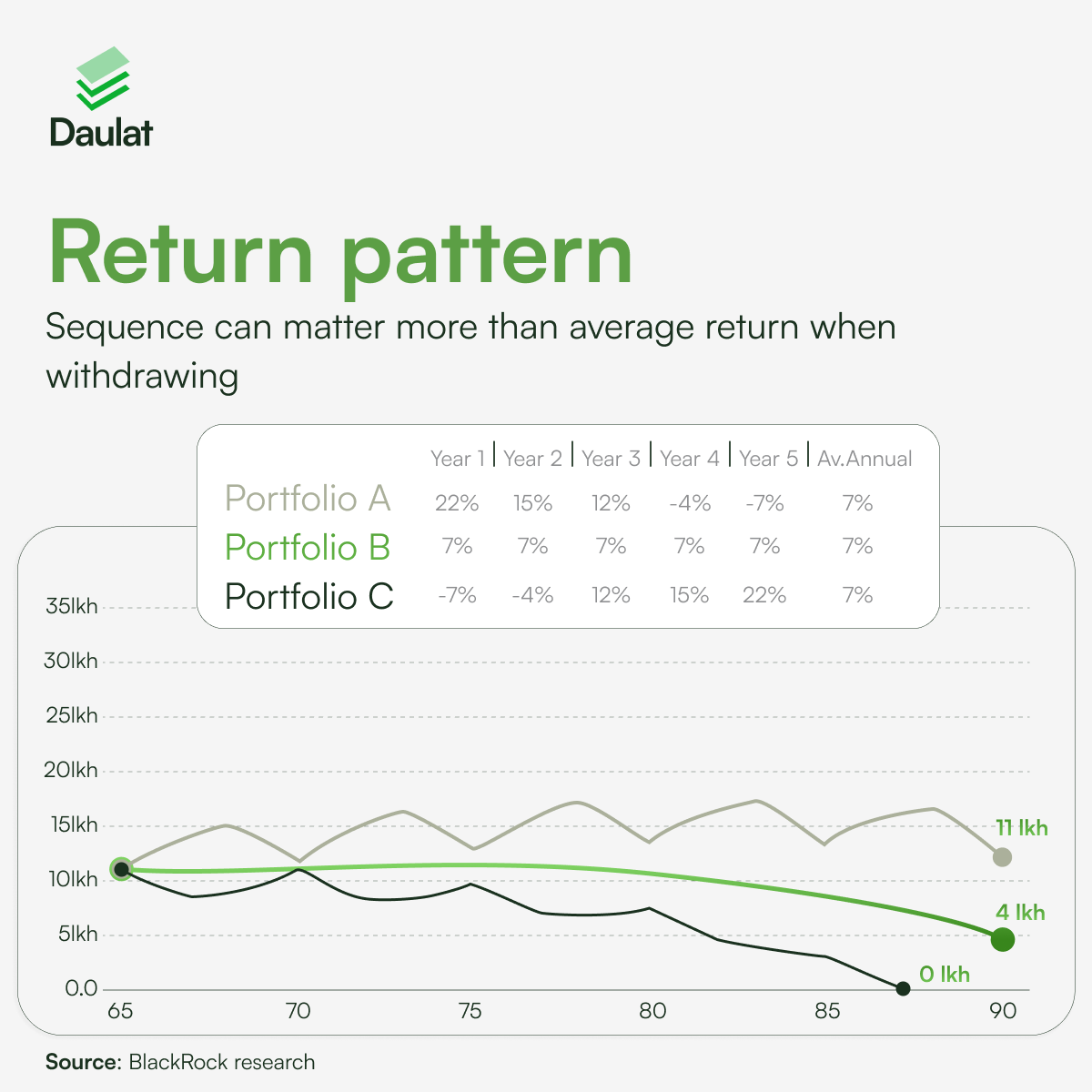

However, things change significantly during the distribution phase of your investment journey or when you are in retirement and would like to withdraw regularly from your investments.

Withdrawals from portfolios often compound losses. This occurs because the drop in portfolio happens when the value of your investment is at its highest i.e. during the start of your retirement – thus it can often take longer for the portfolio to recover. In the above example, we have added annual withdrawals of INR60,000 adjusted annually by 3% for inflation. As we can observe, a person affected by the sequence of returns risk will not have his retirement savings last through the 25-year period until 90.

How to mitigate the risk?

While it is very difficult to accurately predict how the markets are going to behave, it is best to be a bit defensive and conservative when it comes to withdrawing from your retirement portfolio. Investors these days often do not have an all-equity portfolio coming into retirement – which offers a good starting point for protecting your portfolio during extended periods of downturn. Here are a few techniques to effectively mitigate the sequence of returns risk:

- Have a cash reserve: History has shown that continual down markets usually do not last beyond 2 years. Hence, to safeguard against a falling market – it is advised to have a year or two’s planned withdrawals set aside as cash. You can set aside this cash in liquid/arbitrage funds which protects your capital while providing some returns. This ensures that you are not being forced to withdraw when it is not the optimal time to do so.

- Higher fixed-income allocation during the distribution phase: The asset allocation of your retirement portfolio needs to have a higher fixed-income/debt allocation vis-a-vis equity compared to your portfolio during the accumulation phase. Debt not only provides a hedge during extended periods of the downturn but also ensures that you are not vastly affected by the sequence of returns risk. A balanced portfolio of 60% stocks and 40% bonds (not investment advice) historically has provided higher visibility and safety of return through the debt allocation while allowing adequate opportunity for the growth of assets via its equity allocation.

- Scaling down equity exposure 1-2 years before retirement: As you approach closer to your retirement age, it is also a good practice to gradually start scaling down your exposure to equity-related securities like stocks 1-2 years before your retirement. A staggered transfer from equity to debt via a Systematic Transfer Plan (STP) is a good method to do so. This ensures that you end up with the planned retirement amount.

FAQs

What is the Sequence of Returns risk?

- The sequence of Returns risk is the risk of receiving of overall lower or negative returns in your investment portfolio when constant withdrawals are made in a down-market.

Who does it primarily affect?

- It primarily affects investors like retirees or anyone who seek constant withdrawals from their investment portfolios.