Introduction

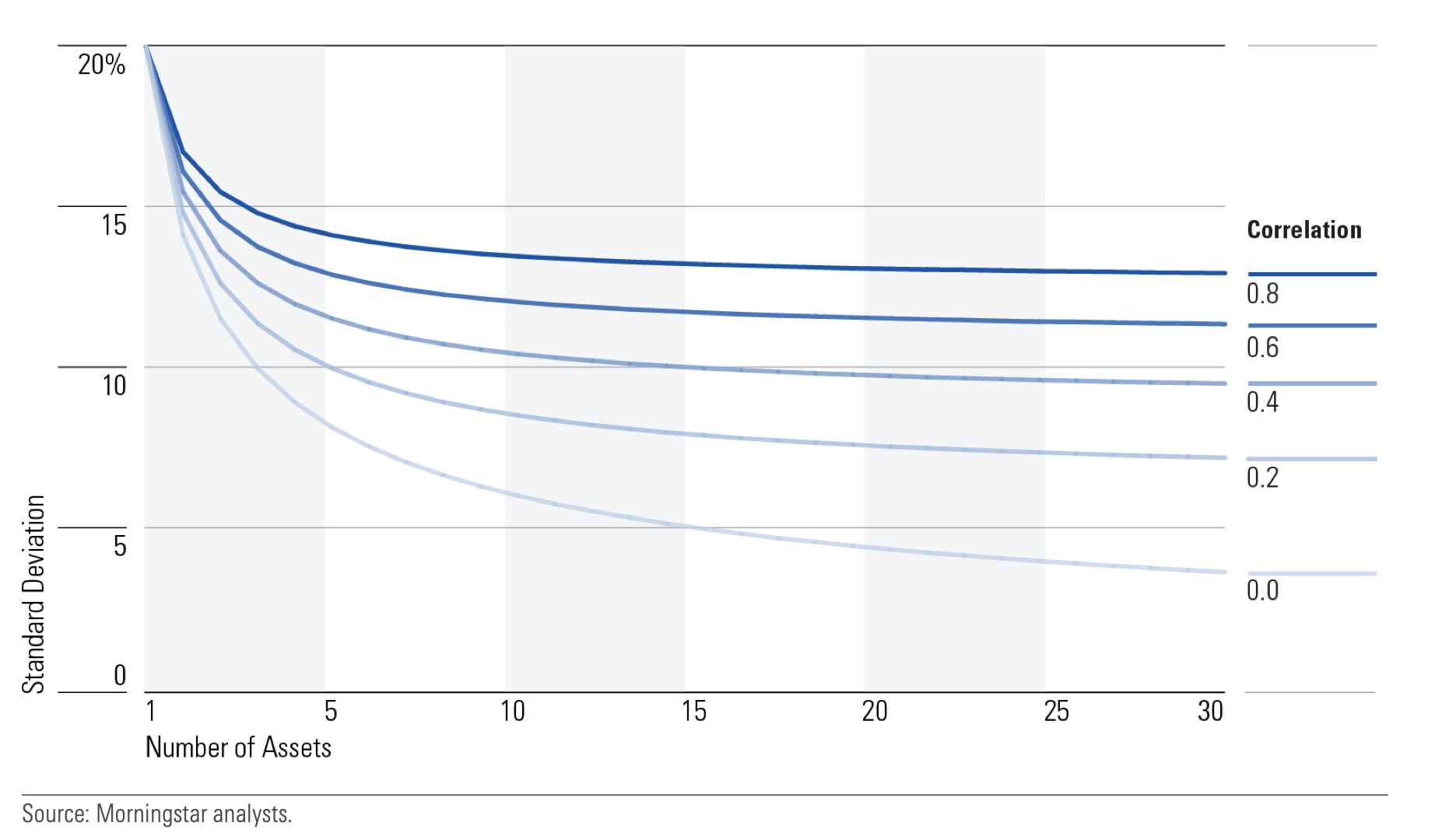

Constructing a portfolio with investments that have correlations below 1 can reduce the overall portfolio’s risk profile. The lower the correlation, the greater the reduction in volatility from adding additional investments. The chart below shows the basis diversification equation.

What Diversification is Not

We have seen a lot of people having wrong and misconceived notions about Diversification. Now that have we have established what it is, let’s quickly also see what it is not:

a. A strategy to maximise returns: Diversification is by no means a guaranteed way to earn positive returns in the equity markets. Diversification merely helps in minimizing against downturns and reducing the overall risk profile of the portfolio.

b. Collecting a bunch of similar behaving investments: People often conflate the no. of investments in their portfolio with diversification. Adding more of similar investments is NOT diversification. One must add asset classes i.e. debt, equities, gold etc. that behave differently in a given market condition.

How to create a diversified portfolio

One then may ask, how do you go about creating a well-diversified portfolio. Our multi-asset solutions — DMAS — build upon the basic building blocks of Diversification to create a suitable investment product curated for you. Here are the 4 basic components of a diversified portfolio:

a. Cash/Money-Market investments: These include money-market funds that are ideal for those who are looking to preserve the value of their investments. They offer stability, liquidity and easy access to your money — however that also comes with a drag on the returns vis-a-vis other bond funds or individual bonds.

b. Fixed Income / Bonds / Debt: Fixed Income instruments, as the name suggests, provide regular income and capital protection. They also often act as a cushion against the unpredictable ups/and downs of the equity markets. This is a low-risk asset class, but that is not to mean that it is not exposed to any risk. Instruments such as debt mutual funds, company FDs, and debentures are often subject to credit and interest rate risk depending on the instrument or the scheme.

c. Domestic Equity: Domestic equities are supposed to be the bedrock of your equity investment portfolio. While the allocation of equities in the overall portfolio will ultimately depend on your individual risk-tolerance level, any equity exposure is important to deliver long-term, inflation-beating returns.

d. International Equity: U.S/European stocks often behave differently than their Indian counterparts, providing exposure to opportunities not offered by Indian securities. Investors should consider carving a certain portion of their portfolio for international stocks that offer higher potential returns but comes with higher risk. Despite the recent stop in certain international instruments due to regulatory restrictions, investors in India can still get exposure to these securities by purchasing the underlying ETF units.

For investors who do not have the time or the resources to dig into each of the asset classes and select the appropriate instruments, our model portfolios provide a one-stop solution. These portfolios are professionally-managed and implemented with a combination of active and passive mutual funds and fund of funds.