Novice investors or those with a lower risk appetite look for more risk-free and stable options like a diversified mutual fund. However, seasoned and experienced investors usually look to increase their risk appetite to earn a little more returns. There are numerous investment instruments that are capable of giving higher returns than others but demand a higher risk appetite. One such high-risk, high reward investment instrument is the credit risk fund.

Understanding Credit Risk Funds

When you invest in mutual funds, your invested capital is divided into equity funds, which includes investing in the stock market, while debt funds, which is a fixed-income security that deals mainly with bonds. Bonds are given ratings based on the credit quality, the issuing company’s financial strength, and the company’s ability to pay interest and repay the principal amount of money. These ratings are denoted as AAA, which is the highest, then AA, A, BBB, BB, B and so forth.

Credit Risk Funds are debt funds that mainly invest in bonds that are rated either AA or lower. To be more specific, These invest about 65% of the funds available to them in lower than AA-rated bonds. Since these bonds do not have the financial strength of higher-rated bonds, their interest payments and principal repayment are not stable. Hence the name Credit Risk Funds.

Credit Risk Funds vs Corporate Bond Funds

Most debt funds are not the same in terms of their risks and returns. Let us compare Credit Risk Funds with Corporate Bond Funds for you to get a better understanding :

| Credit Risk Funds | Corporate Bond Funds |

|---|---|

| A debt scheme that has to invest a minimum of 65% of its available funds in bonds rate AA or lower. | A debt scheme that has to invest a minimum of 80% of its available funds in bonds rate AAA |

| For high risk appetite investors | For low risk appetite investors |

| Higher Returns | Lower Returns |

How do Credit Risk Funds Generate Returns?

Credit Risk Funds reward their investors for the extra risk they are ready to take by investing in lower-rated bonds (AA and lower). Because these invest in lower-rated bonds, the bond issuer pays more interest to the Mutual Fund, who pay a higher interest rate to their investors. Secondly, if and when these bonds become better rated, the capital gains achieved can be high, and the investor gets higher than normal returns for their investment.

Are Credit Risk Funds safe and who should invest in them?

Investors with a higher risk appetite are the ones who should be investing in these funds. Despite being a kind of debt fund, Credit Risk Funds have high associated risks. It is entirely possible that instead of the bond ratings improving, they may even go further down. This volatility is part of these funds, and only those investors with a high appetite for risk should invest in credit risk funds. Investors looking for low-risk and stable investments should avoid these funds.

SEBI Measures

In recent times, SEBI has taken multiple measures for the safeguarding of retail investors. SEBI has mandated credit risk fund issuers to invest 10% of their total assets in liquid assets such as Government securities, bonds, cash, etc. The move will help enhance the liquidity of credit risk funds which will help them face pressures if any. This move by SEBI has resulted in 2 outcomes :

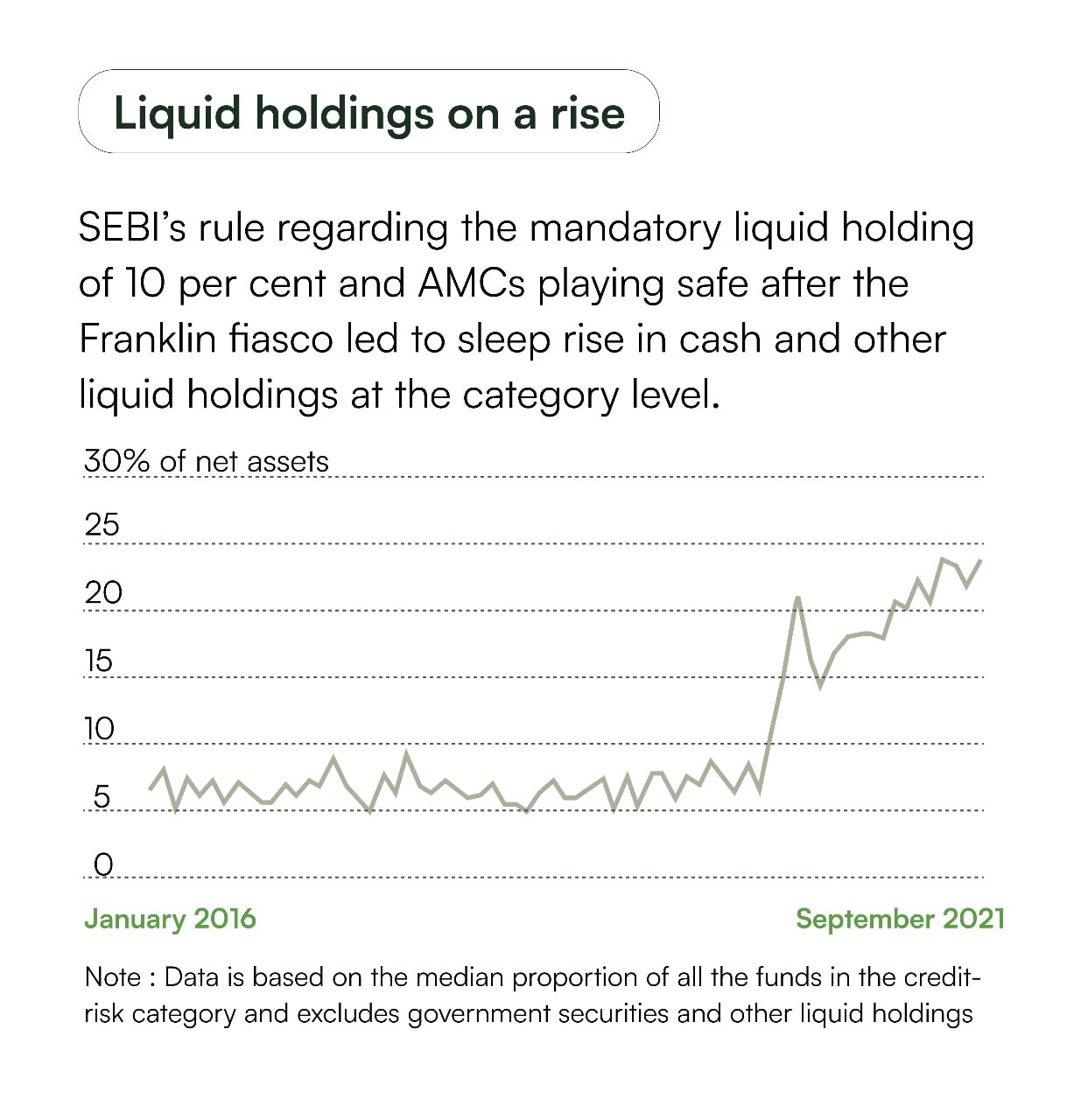

- A rise in the liquid holding of Credit Risk Funds : The table below can demonstrates that the Credit Risk Funds have increased their liquid holding much higher than the 10% threshold mandated by SEBI.

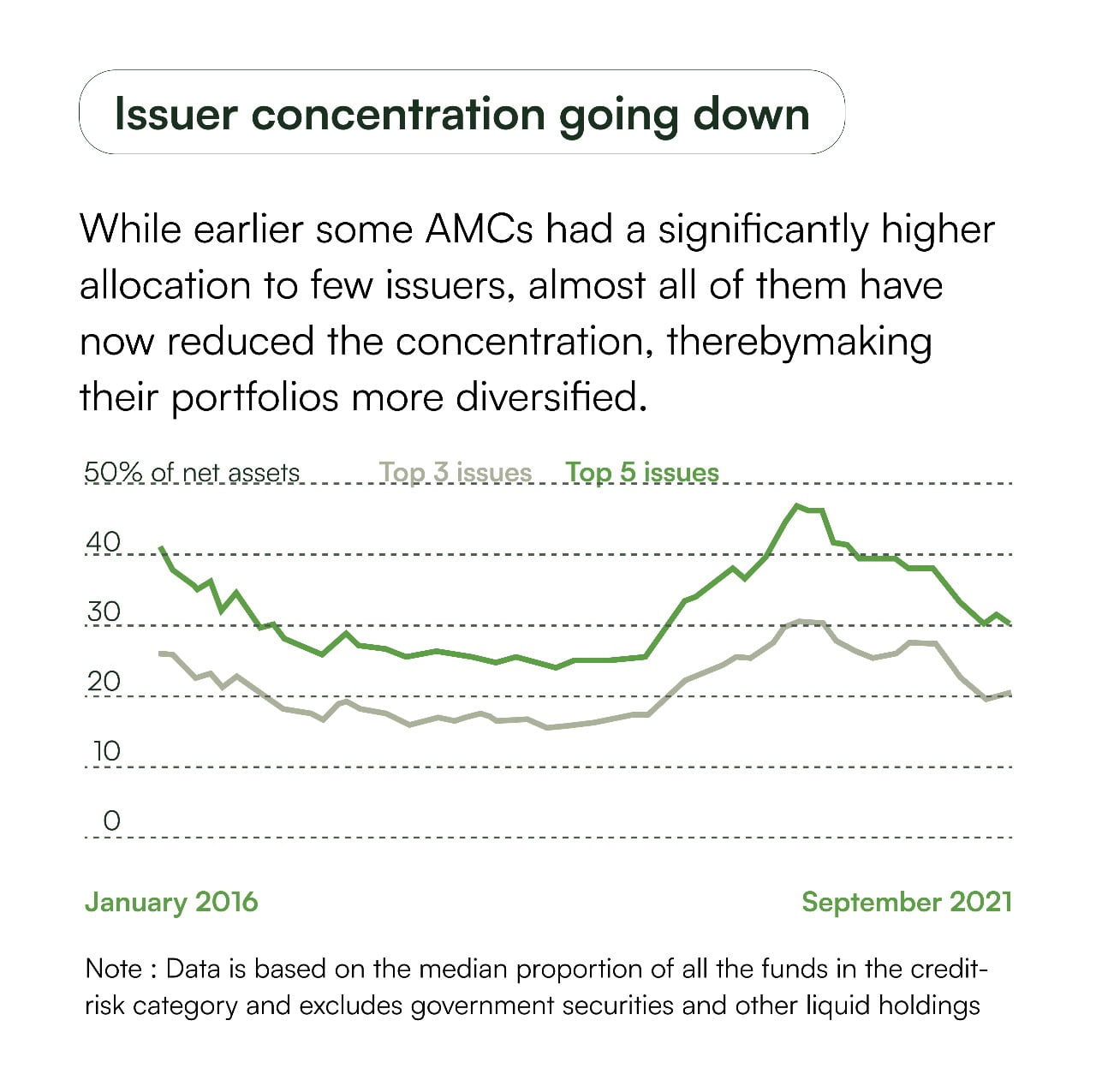

- Reduction in Credit Risk Fund issuers : Many credit funds have reduced their issuer concentration. So, now the percentage of net assets held by the top three and top five issuers has gone down. It has made the credit risk portfolios more diversified, thus reducing the risk for investors.

These measures have resulted in the Credit Risk Funds being much more diversified, making them suitable for even more investor classes.

Understanding Taxation

Since credit risk funds are a type of debt funds, they are taxed as short term capital gains for up to three years and as long term capital gains for periods of more than three years. The short term gains tax is dependent to the income tax slab of the investor. The long-term gains tax for debt funds is fixed at 20%.

To Conclude Things

In conclusion, credit risk funds can be an easy way to earn higher than normal returns by investing in lower-rated bonds. But, as is the case with almost all forms of investments, if the potential for profits is high, the associated risks are high as well. If you are willing to take those risks to get excellent returns, then these credit risk funds might just be your cup of tea. However, it is advised that you do extensive research about the issuing company and the available bond options before investing in Credit Risk Funds.