The Indian market offers a wide range of financial assets for investment. They are separated into different categories based on a variety of variables. Equities and fixed income securities make up most of the market’s instrument types. Equities are market-dependent, whereas fixed-income securities offer modest but reliable and timely returns.

In this article, we will take a plunge into the world of Fixed Income Securities and learn the benefits and risks of Fixed Income Securities.

What are Fixed Income Securities?

Fixed income securities are a type of debt instrument that guarantees returns in the form of stable and predictable interest payments or coupons that eventually return the invested principal at maturity, regardless of market fluctuations.

Fixed income securities’ payments are predetermined, in contrast to variable-income securities, whose payments fluctuate depending on some underlying factor, such as short-term interest rates. The final value at maturity is determined before the fixed-income security is issued. During the investment process, it is made known to the investor.

For instance, if an investment guarantees a 5% annual rate of interest and one’s deposit is Rs 1000, then the user will earn Rs 50 on their deposit every year, irrespective of market volatility.

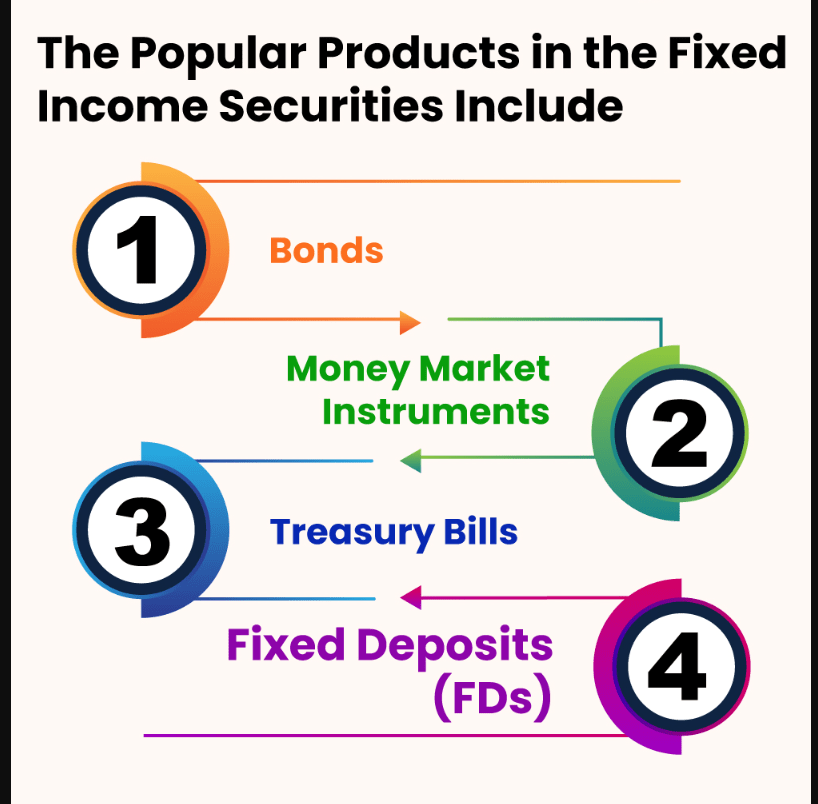

Types of Fixed Income Securities

- Bonds: Debt security offered by the government.

- Money market instruments: Short-term security convertible to cash.

- Treasury Bills: Issued by the Central government to raise money with short-term maturity periods (91 days, 182 days, 364 days).

- Fixed Deposits (FDs): One-time investment with a fixed interest rate for a fixed short- and long-term period.

- Recurring deposits: Periodic investment done with a fixed interest rate for a fixed short- and long-term period.

- Public Provident Fund (PPF): Long-term savings scheme in which the principal amount and interest are tax-free.

- National Savings Certificate (NSC): Investment for the future done through the post office with a tenure of 5 years.

- Senior Citizen Saving Scheme (SCSS): Lump sum investment up to 15 lacs to get quarterly interest amount for people above 60 years of age.

- Sukanya Samriddhi Yojana (SSY): Savings scheme for girl child.

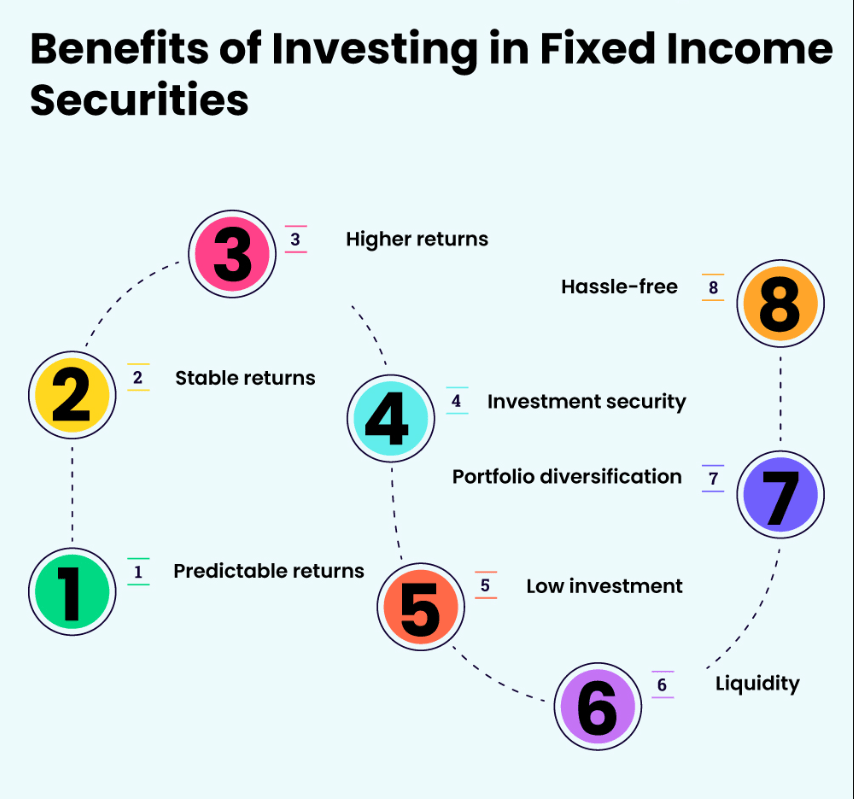

Benefits of Fixed Income Securities

Capital security

Unlike stocks or equities, the investment in the plan isn’t exposed to price swings and is, therefore, at a lower risk. Due to the government’s backing of most assets, it is extremely unlikely that interest or principal payments will be missed.

Guaranteed returns

Fixed income securities offer predictable returns by charging a set interest rate. They are a good substitute for bank savings accounts, which provide low-interest rates on deposits because the returns are unaffected by market performance.

Tax benefits

Investing in fixed income securities allows you to save up to Rs 1.5 lakh in taxable income under Section 80C. In some cases, such as PPF, the interest earned is tax-free.

Suitable for financial goals

A safe passage to opt for long-term and short-term financial planning with very few hazels and fixed returns.

Liquidity

Redeem the bonds as required. In the worst-case scenario, investors who hold the issuer’s corporate bonds, if the issuer files for bankruptcy, have priority over those who own equity or are stakeholders.

Portfolio diversification

A concentrated portfolio of equities can benefit from the diversification provided by investments in fixed-income securities because they lower the overall risk of the portfolio’s ability to generate stable returns.

Risks of Fixed Income Securities

Credit risk

It occurs when the bond issuer neglects to pay the security at maturity. The investor may forfeit the right to future payments or even their principal in the event of a default. It is less of a problem with government debt instruments like bonds or treasury bills.

Interest rate risk

Changes in interest rates have an impact on bond prices, which then affect debt mutual fund returns.

Inflation risk

The effective return is worth less if inflation exceeds the interest rate paid by the security. Rising price levels put investors at risk because they reduce the purchasing power of cash flows from fixed-income securities.

Spread risks

It may occur from the risks emerging from the changing value in the financial asset market due to fluctuations in credit spread.

Liquidity risks

The likelihood that a seller of a fixed-income asset will be unable to find a buyer is known as liquidity risk.

Reinvestment risks

The bond issuer reserves the right to “call” the bond before maturity and settle the debt in the case of callable bonds or if the interest rate drops.

Conclusion

An investor may have difficulty selecting the appropriate investment instrument, so it is highly advised to invest according to personal and financial conditions. The benefits and risks discussed above can help you broaden your understanding. Even if you have high-risk tolerance, investing in fixed income securities can help diversify your portfolio.