There is a famous saying – “Putting all their eggs in one basket”, in financial terms it often means putting all your assets into one resource or asset class but if the asset class dips, one loses all their money. Although it might be a high risk-high reward proposition, following this method is not ideal if one wants consistent returns. So in-order to diversify your assets into different resources, one uses the concept of asset allocation.

Understanding Asset Allocation

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk appetite, and the duration of their investment. The three main asset classes of investments, i.e equities, fixed-income, and cash and its equivalents—have different levels of risk and return, so each will behave differently over time and will suit the expectations of each individual differently.

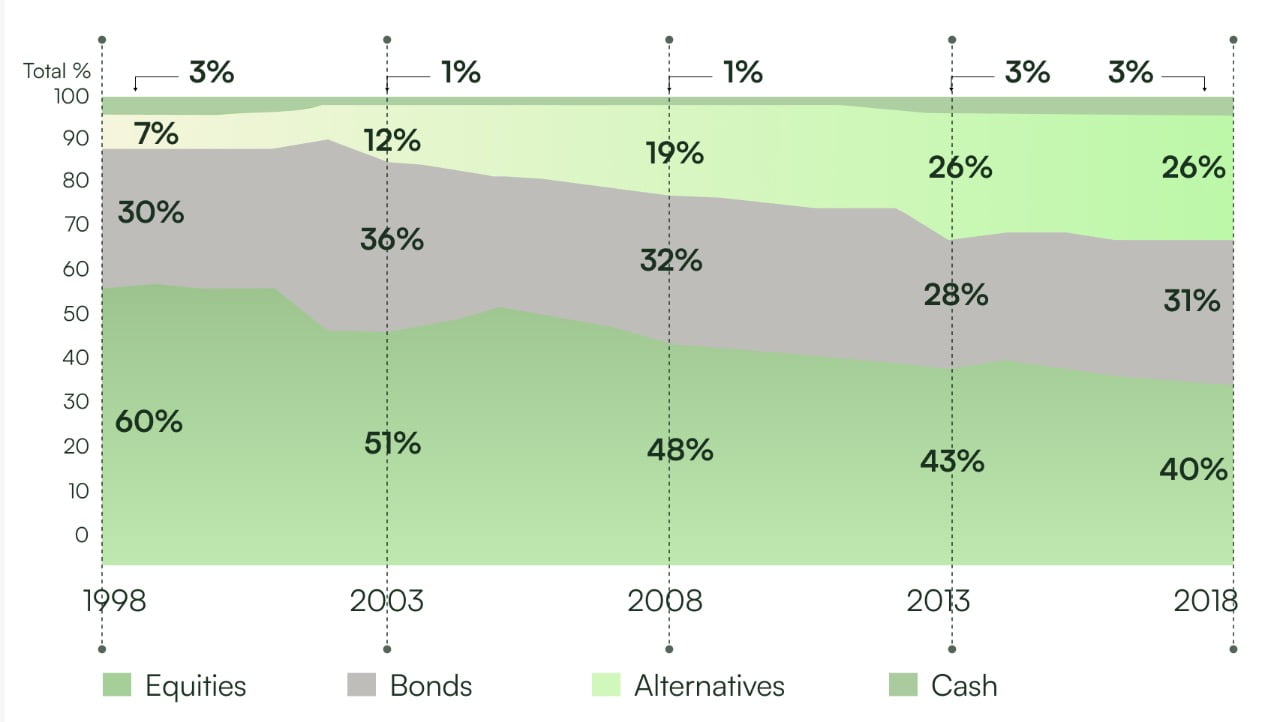

Historically equities have usually been the major constituent in asset allocation schemes, closely followed by bonds and alternatives. This trend shows that people don’t mind a riskier outlook towards investments, if invested for a substantial period.

The importance of asset allocation

There is no simple formula that can determine the right asset allocation for every individual investor. However, the general consensus among most financial professionals is that asset allocation is one of the most important decisions that investors usually make. In other words, the selection of individual assets (for eg – which stock to buy?) is secondary to the way that assets are allocated in stocks, bonds and cash and equivalents, which will be the principal determinants of your investment results.

Another important factor of asset allocation is that it allows you to tweak your portfolio to exactly match your risk appetite. Doing this, makes the chances of you meeting your financial goals much easier.

Allocating assets also secures you from the emotional turmoil caused by any irregular movements in the market. An asset allocation based approach takes emotions out of the process of investing and keeps you disciplined. You should always invest according to your asset allocation irrespective of any market movements.

Types of asset allocation strategies

- Strategic asset allocation : In Strategic Asset Allocation strategy, the fund has static asset allocation mix and does not change no matter the movements in the market. Strategic asset allocation is similar to the buy and hold strategy in stocks and bonds. One of the major advantages of strategic asset allocation with a stable rebalancing strategy is that it enforces discipline in investments.

- Dynamic asset allocation : In this asset allocation strategy, one continuously adjusts their asset allocation mix depending on market conditions and trends. The most common dynamic asset allocation strategy used by mutual funds and asset managers is the counter-cyclical strategy. These funds increase their equity allocation (reduce debt allocation) when equity valuations decline (become cheaper) and reduce debt allocations.

- Tactical asset allocation : Tactical Asset Allocation is a variant or subset of Strategic Asset Allocation strategy where the investor can occasionally deviate from their long term Strategic Asset Allocation plans to take advantage of market opportunities. Tactical asset allocation calls for understanding market timing and requires considerable investment expertise.

Rebalancing and Asset Allocation

Rebalancing is what investors make use of to bring their portfolio back to its original asset allocation ratio. Rebalancing is needed because over time, some investments might grow faster than others. This may push your holdings out of alignment with your investment goals. By rebalancing, you will ensure that your portfolio does not overweight a particular asset category, and you’ll return your portfolio to a comfortable level of risk, suitable to your needs.

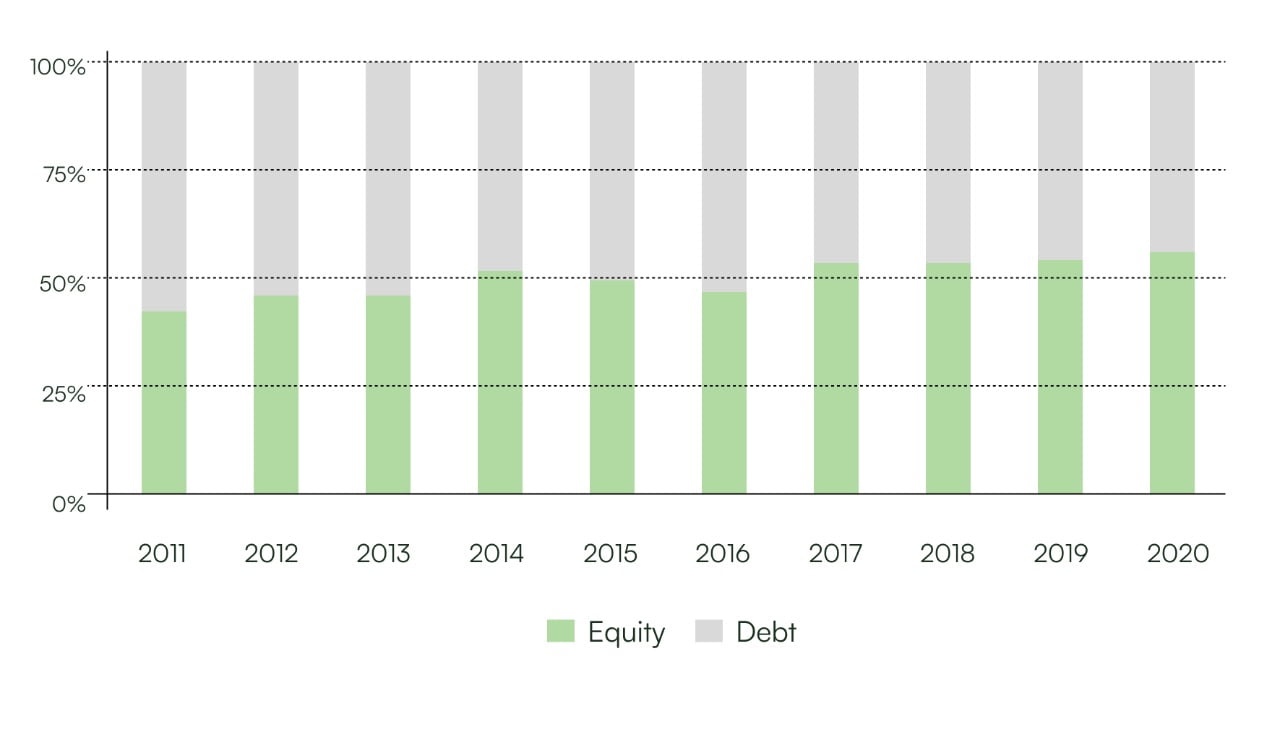

For example, you might start with 50% of your portfolio invested in stocks, but see that rise to 70% due to market gains. To reestablish your original asset allocation mix, you’ll either need to sell some of your stocks or invest in other asset categories by putting in more money. The below image shows how a portfolio comprising of 50% equities and 50% debt will change over a period of 10 years.

How to determine your asset allocation ratio?

Determining your ideal asset allocation ratio is very important in anyone’s financial journey and there are multiple factors at play to determine this ratio :

- Your different financial goals – short term, medium term and long term

- Your risk appetite – lower your risk appetite, higher the debt allocation. (Try taking our risk assessment test to determine your risk appetite.)

- Your age – younger investors may have higher allocation to equities

- Your assets and liabilities – if you have substantial liabilities, you should not take make exposure to equities

- Your current investment portfolio and its asset allocation

To sum it all up

Asset allocation or the selection of individual assets is secondary and much less important to the way that assets are allocated in stocks, bonds and cash and equivalents, which will be the principal determinants of your investment results.