After a roller coaster journey which 2022 was, it ended with middling returns for investors of all classes. As we kick off the new year, investors may be thinking about what will shape their investing journey in 2023. Here are five big investing themes that may dominate the year.

What will inflation look like in 2023?

The return of inflation was one of the biggest scares of 2022. Global consumers were coping with price increases the likes of which they hadn’t seen for many decades. So it’s only natural for people to be nervous about what’s in store for them on the inflation front in 2023.

After decades of relative quiescence and financial stability, prices surged to levels last seen during “the Great Inflation” of the late 1970s and early 1980s. The consumer price index or CPI peaked in June 2022 above 9%, although the key measure of U.S. inflation has slowly drifted lower since then.

While CPI remained relatively elevated in October—up 7.7% year over year—observers have dared to hope that the downward trend could continue as we enter the new year. A few have even argued that we’ve reached peak inflation, thanks in part to the Federal Reserve’s campaign of interest rate hikes.

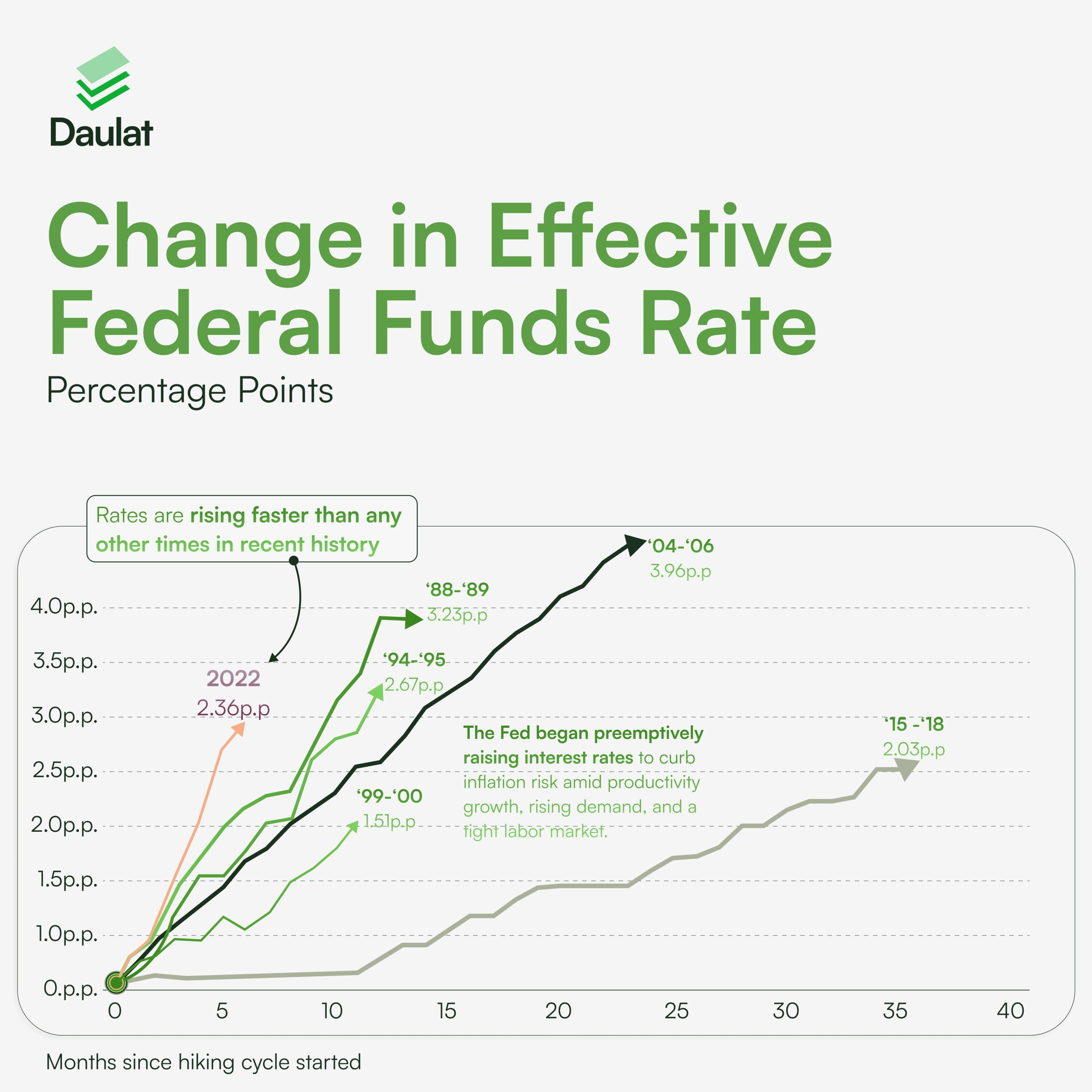

The Fed has raised interest rates six times in 2022, significantly higher than past hikes and the rates were hiked once again in December. After two modest rate increases in March and April, the Fed implemented four massive 75 basis point (bps) rate hikes in the second half of the year.

The federal funds rate may have gone from zero at the start of 2022 to nearly 5% by year’s end, but experts expect the Fed to pivot on policy—with major implications for inflation in the year 2023.

Covid Scare

Worries about the spread of a new variant of Covid have substantially dented market sentiment, worrying investors in recent weeks. But investors are growing concerned that the fresh wake in North Asian countries like China and Korea will result in a sharp selloff. This factor will, however, add to the anxiety of investors, who are already on the edge.

There’s no certainty that new variants will emerge that have an effect on the scale of delta or omicron variants, but it is possible. Should this occur, it’s important that plans are in place to respond in the context of personal finance. Keeping rising covid cases in mind, financial plans should be made to counter these effects. A good practice would be to keep a substantial emergency fund in place and keep a relatively covid proof portfolio.

Re-emergence of bonds as an asset class

The year of 2022 has been challenging for debt markets and investors alike as the Reserve Bank of India (RBI) took the rate hike route due to high CPI inflation and aggressive/repetitive hikes by US Federal Reserve. The ten-year yield has moved drastically up, from 6.75 % to 7.30%.

The cash liquidity of the banking sector in general has come down significantly and credit growth continues to be robust at 17% levels. Further, deposit growth has picked up with nationalized banks increasing their deposit rates aggressively. This, as per experts, may make them incremental buyers in government securities and corporate bonds in the upcoming financial year in the short and medium end of the yield curve.

Probability of a recession

Consumers and governments across the world are worried about the ‘R’ word or recession. The current set of macro-economic conditions is a result of a confluence of multiple factors and events that we all experienced in 2022 — starting with the Russia-Ukraine war driving the energy and commodity prices higher to the rate hikes and sticky inflation. Consumers have tightened their purse strings in anticipation of a downturn in 2023.

IMF recently predicted that a third of the global economy will be hit by recession this year and warned that ‘world faces a tougher year in 2023 than the previous 12 months’. The evolving COVID situation in China is likely to be a drag on the worldwide economic growth for the first time in 40 years.

However the situation plays out, it is say to assume that we are living in an increasingly uncertain world and thus should remain cautious of what is to come next.

Bottom Line

Investing in general will always come with some level of risk. There are no guarantees of profits when attempting to make a return on your money. The goal is to become knowledgeable about different market conditions, to identify recession-proof industries and continue to invest in companies and opportunities you believe in.