The world is full of uncertainties. No one knew that COVID-19 would disrupt our lives and create a “new normal”. Many of us were unprepared for a global pandemic that led to many problems ranging from job losses to health emergencies. To be well prepared for any such unexpected occurrences in the future, it is essential to have an emergency fund.

So, what exactly is an emergency fund?

Emergency funds refer to a corpus of funds set aside for unanticipated financial shortfalls. They are kept explicitly for crises and must not be used for routine tasks.

But why do you need an emergency fund?

Primarily, having an emergency fund increases your financial security. People often do not have money preserved for unfortunate times, and when bad luck rings their doorbell, they must rely on external debt or other savings like the retirement fund to keep themselves afloat. The need for emergency funds can arise anytime in the form of car repairs, home repairs, medical bills, or loss of income. The requirement may be big or small, but it is always recommended to have liquid funds available for emergencies.

The peace of mind that comes with knowing that you have a certain amount of money put aside to deal with unplanned emergencies is priceless.

The next big question is how much you should put in your emergency fund.

The short answer is it varies. It depends on several factors, including your income, expenses, way of living, pre-existing debts, etc. Maybe for someone living alone, 3 months’ worth of expenses could be sufficient for an emergency fund, but for someone who is the family’s sole breadwinner, they might have to save 6 months or more of their expenses.

How to calculate the fund requirement?

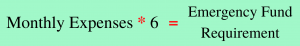

A good safety net is to keep at least 6 months’ worth of your expenses in the emergency fund. For that, first, make a list of all your necessary expenses in a month. This requires you to distinguish between extravagant expenses and essentials. Here is a reference list:

What necessary monthly expenditure includes:

- Rents, bills, and debt payments

- Food

- Medicine costs

- Transportation costs

- Savings or employee pension contributions

- Money given to dependents

What necessary monthly expenditure does not include:

- Vacations

- Expensive clothes, electronics, bags, etc.

Once you have a clear idea about your total monthly expenses, you can multiply it by 6 (or whatever number of months you choose) to determine your emergency fund target amount.

How to build your emergency fund?

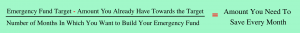

Once you have determined the amount you want to set aside for emergencies, you need to plan how you’ll save that much because there’s a good chance that you do not have that amount readily available. You can use the following formula as a guide towards efficient savings:

For example – Suppose your Emergency Fund Target is Rs. 1,80,000, and the amount you already have towards the target is Rs. 60,000. You aim to get the emergency fund ready in 6 months. This means the amount that you will need to save per month = (1,80,000 – 60,000)/6 = 1,20,000/6 = Rs. 20,000.

The most confusing part of this process is where to keep the emergency funds.

As discussed previously, the foremost requirement from an emergency fund is liquidity. So, should you keep the entire amount in your cash or bank account? No, you would want to earn decent returns on your funds, but you would also like to be careful of market volatility and its risks. Thus, the ideal thing would be to spread this money across liquid funds, short-term Recurring Deposits (RDs) and debt mutual funds.

For example – Suppose you have successfully accumulated Rs. 1,80,000 as stated above. Now, you may decide to keep Rs. 30,000 in cash at home and Rs. 50,000 in your savings bank account and invest the remaining Rs. 1,00,000 in a liquid mutual fund.

What are liquid funds?

A liquid fund is a class of debt funds that invests in debt instruments with a maturity of less than 91 days. These are high-rate papers which are not affected by fluctuations in interest rates. Hence, they successfully earn decent returns without being volatile.

The final question we will address is how to redeem these funds in emergencies and what to do after the emergency fund has been used.

Most liquid funds allow instant redemption of up to Rs. 50,000 or 90% of the invested amount. Thus, you can redeem the money whenever needed, and it will be directly credited to your linked bank account. Make sure to check whether the facility of instant redemption is available before investing in any fund.

Once you have utilized the firm for an emergency, it is time to restart the process of fund accumulation all over again. Obviously, this will require you to make certain lifestyle changes to accommodate those extra savings, but till now, you would have realized that it is totally worth it. Emergencies do not occur with an invitation, so it is necessary always to be prepared.

If you need any help setting up your emergency fund or are confused about where to invest, you can contact us at Daulat because we are always here for you!