The wealth management industry has experienced an exemplary change in the last few years spearheaded by changing demographics with a dramatic increase of millennials joining the investing wagon, and rapid digitalization. The past few years have been nothing less than a Midas Touch for investors. The equity market continued to soar to new highs, drawing a large number of first-time investors. Testimony to this fact is the number of Demat account openings hit a record of 14.2 million in FY 2021. These developments are creating new exciting opportunities and challenges for the wealth management industry

Shift in investor demographic

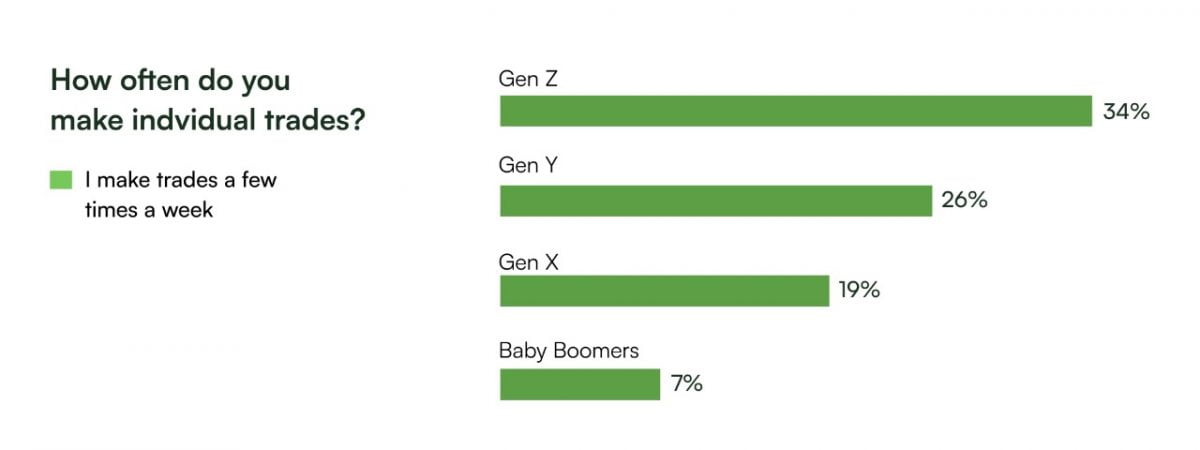

The younger generation are much more financially educated, have access to expert knowledge and financial tools and are actively investing in a structured manner, with specific goals to achieve. The new generation of millennials and Gen-Z individuals are digital first and always connected. They expect 24/7 access to portfolio data and new investment opportunities with rapid growth potential. Capturing this rather tricky market is vital for the wealth management industry.

Digitalization of the wealth management infrastructure

Human connections and personally developed relationships have been the bedrock of the wealth management industry – and will continue to be so. New investors still want someone to guide them through their various financial endeavors. But the need for easy to use digitalized wealth management solutions has never been greater. Digital wealth management is not limited to offering digital channels for managing assets and performing transaction; it extends to using technology to offer a greater value, professional service and improving the customers’ investment experience. Advisors should also embrace these digital tools. Using big data and analytics will be vital for the future of the wealth management industry.

Emergence of new asset classes

More and more retail investors are moving beyond traditional asset classes like fixed deposits and equities because of sub-optimal returns and growth rates, thus urging them to look for alternate opportunities. The emergence of new asset classes such as, Crypto Currencies, NFTs, hedge funds and ESG investments have intrigued the masses. Owing to this, the wealth management offerings are thus going to change dramatically and will definitely move beyond the usual run of the mill sophisticated products.

Need for personalized portfolios

Wealth management solutions will no longer remain a one-product-fits-all strategy and will move towards hyper-customized advisory based on the risk appetite, goals and time horizon of the investors. Investors expect investment opportunities that align with their future goals like building a retirement corpus. The ability to a understand clients’ needs and personalize to those is a key value and differentiator for advisors, putting them leagues ahead of robo-advisors.

Increasing need for guidance

Financial markets have become much more complex due to a wide variety of investments options available in the market today. Investors are often left baffled regarding which products to invest in and how to determine the suitability of these choices based on their own risk taking capacity and the goal they wish to achieve. The need for an unbiased wealth manager, who can handhold and guide the investor through their financial journey, has, therefore, increased manifold. Investors value honest advice on how to achieve multiple yet conflicting goals through a range of investment and funding strategies.

While this means that there will be umpteen new opportunities for the wealth managers, excessive competition has also posed a new challenge to sustain, grow, and strive in this ever growing market. This is a rather challenging environment for investors and their advisors to find the right return-risk combination. Increasing regulatory burdens and the growing costs of risk pose new challenges to wealth management firms and their clients.

Financialization of assets is growing

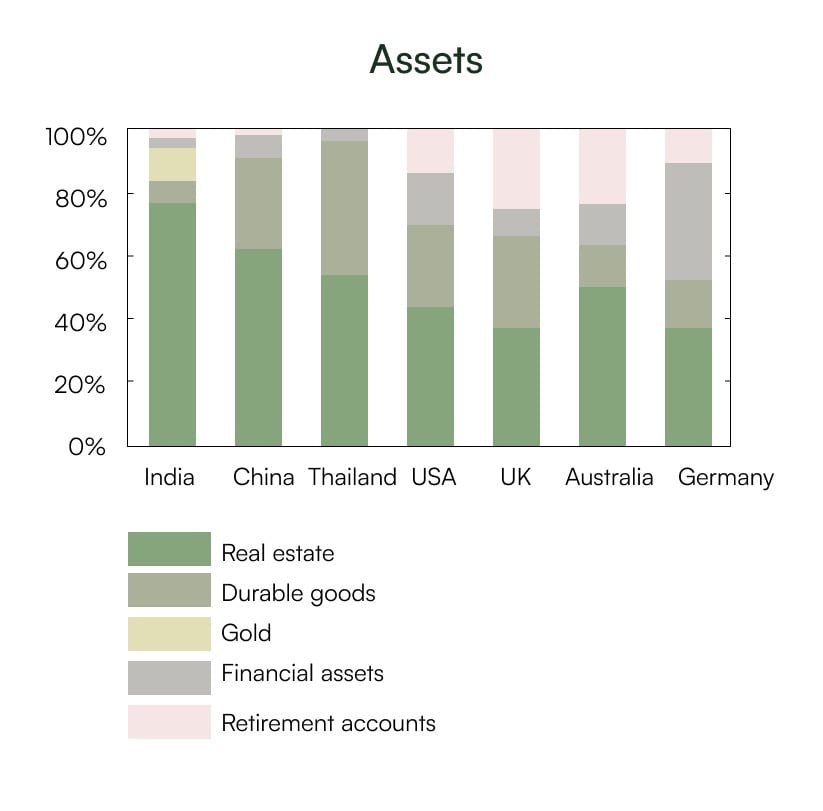

Historically over 95% of personal wealth of the Indian population was stores in physical assets such as gold and real estate.

But all that is changing very fast. The Indian population is increasingly preferring financial assets over physical assets, which has led to the ‘financialization’ of savings in our country. The intensity of the growing financialization of assets can be gauged by the fact that the Assets Under Management (AUM) of the Indian mutual fund industry has spiked dramatically, growing over four-fold in the last 10 years. The population now is much more aware that concentration of assets in non-financial assets can cause huge loses in the face of inflation. With a much more diversified portfolio-building approach, they can enjoy better returns, as well as better efficiency from a liquidity and contingency planning point of view

To wrap it up

In a nutshell, the wealth management industry is at the cusp of a major transformation and most of the upcoming trends are related to accessibility, technology, and customer-centricity. However, the time-tested fundamentals of investing still remain the same and should still be the main focus.