At Daulat, our mission is to bring the benefits of an institutional-grade portfolio construction technique to every investor in India. Due to our ‘Free Portfolio Consultation’ service, we have been able to get access to hundreds of portfolios from investors all across the country (you should check it out too!). We will use a couple of them as a segue to answer the above question.

Let’s play a small quiz: Can you make out what’s wrong with the below 2 portfolios?

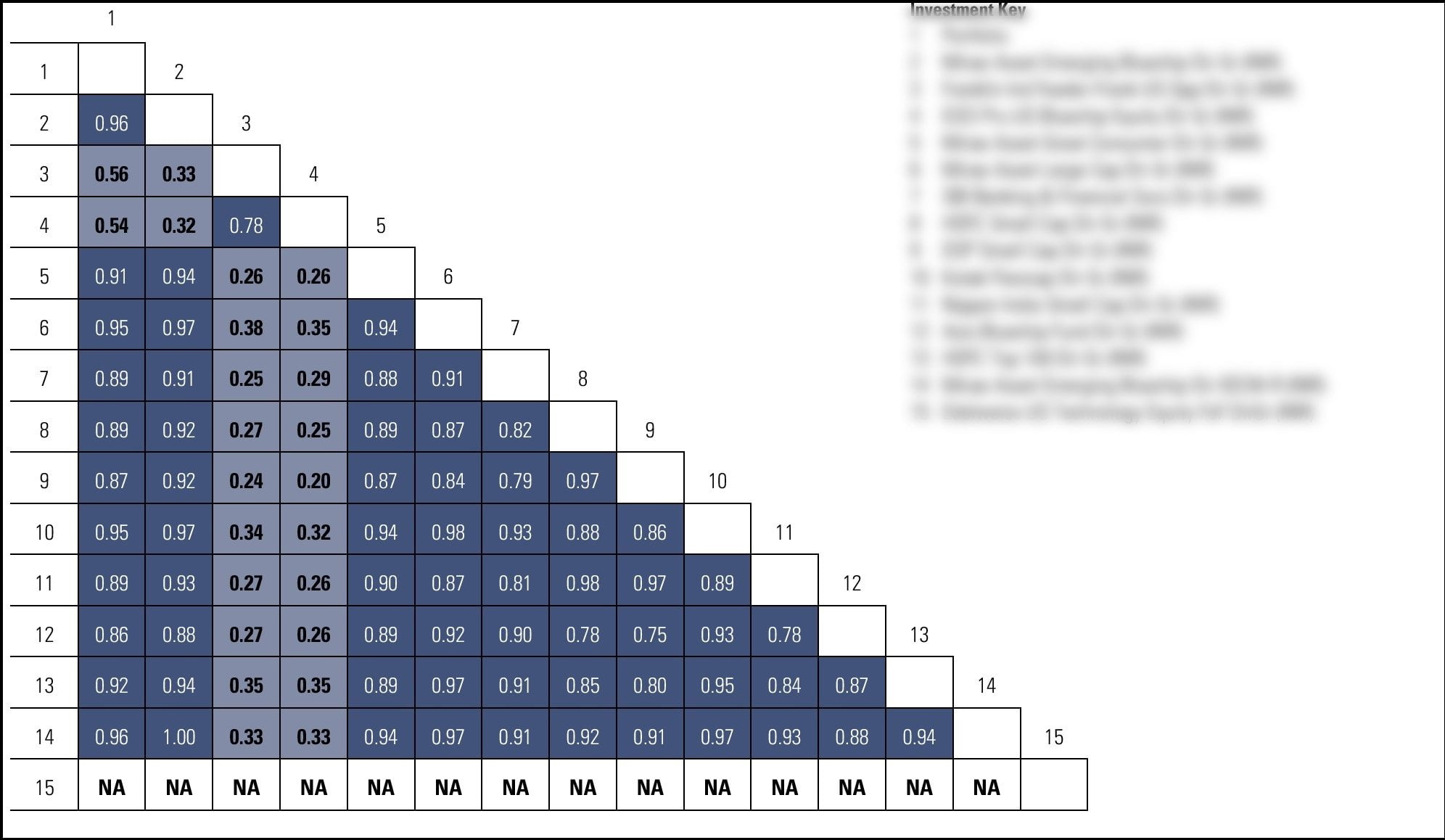

Fig.1: A correlation matrix of a collection of 15 funds

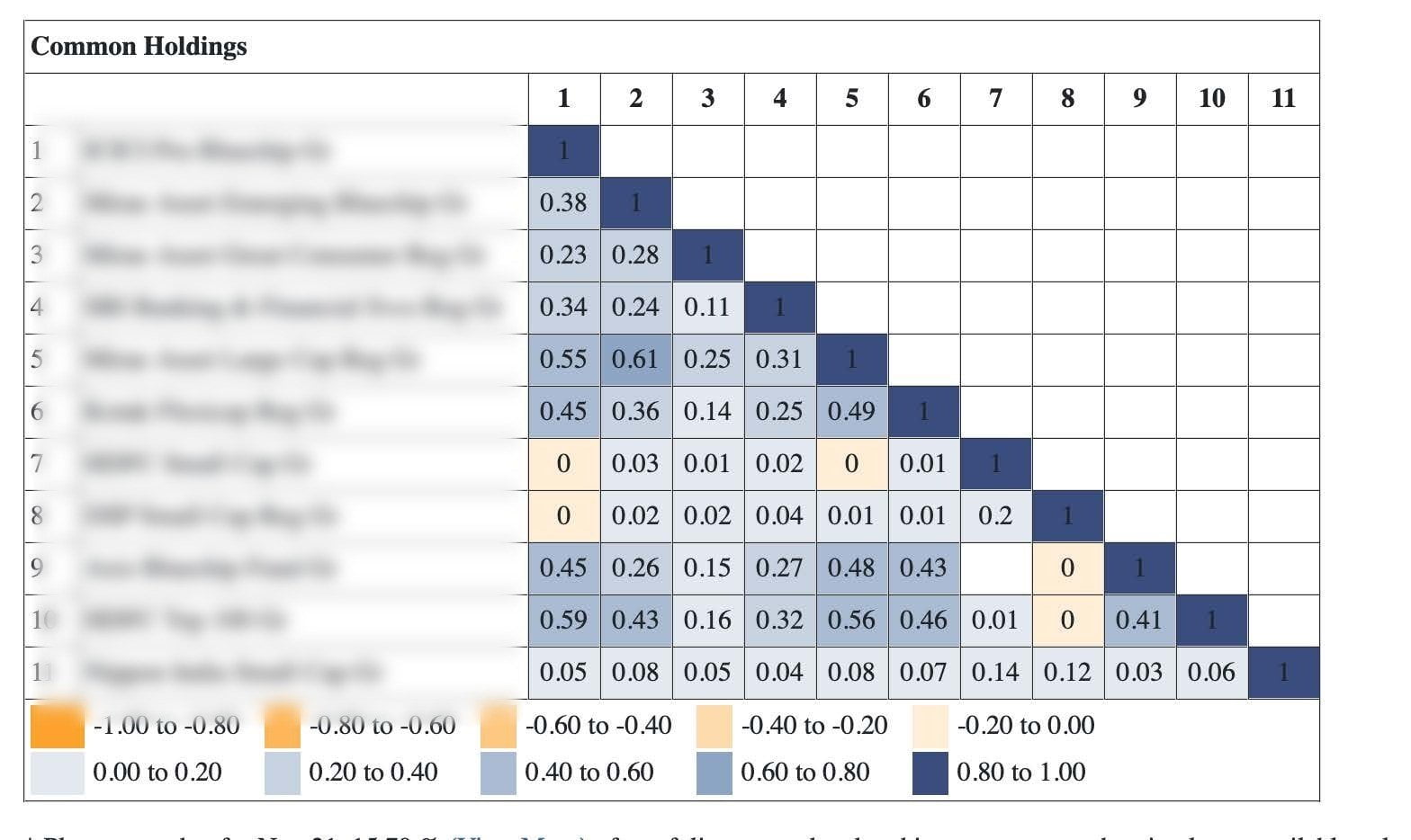

Fig 2: Common Holdings overlap of 11 equity funds

If yes, then great! You are on a good track.

And if not, and if you are still investing via Direct Plans – then you need to seriously reconsider your investment decisions.

Let’s quickly recap what each of those terms mean.

Mutual fund investments in India are currently offered under two plans:

Direct Plan: Direct plans are offered, as the name suggests, directly by the AMC/mutual fund company. Since there is no direct involvement of any third-party agents like brokers/distributors, these plans have a lower Total Expense Ratio (TER). TER typically accounts for commission/brokerage charges paid to the intermediaries – which in this case is zero. Anyone can purchase these plans either directly from the AMCs website or through various internet platforms which offer these plans.

Regular Plan: Regular plans are often sold through an intermediary. These third-party intermediaries can be banks/distributors/advisors etc. The mutual fund company pays a small fee in the form of a commission to these intermediaries for facilitating investments into their schemes. This is reflected in the scheme’s TER and hence these plans have a higher TER than Direct plans.

The table below outlines the differences between a Regular and Direct plan:

Parameters

Regular Plan

Direct Plan

Total Expense Ratio

Higher

Lower

Net Asset Value

Higher

Lower

Returns

Marginally Lower (due to a higher TER)

Marginally Higher (due to a lower TER)

Mode of Purchase

Online/Offline through a third-party

Online/Offline directly from the fund company

Optimal portfolio construction

Provided by the advisor

Not available

Portfolio rebalancing

Provided by the advisor

Not available

Tax-loss Harvesting

Provided by the advisor

Not available

Personalized Investment Advice

Provided by the advisor

Not available

Parameters

Regular Plan

Direct Plan

Total Expense Ratio

Higher

Lower

Net Asset Value

Lower

Higher

Returns

Marginally Lower (due to a higher TER)

Marginally Higher (due to a lower TER)

Mode of Purchase

Online/Offline through a third-party

Online/Offline directly from the fund company

Optimal portfolio construction

Provided by the advisor

Not available

Portfolio rebalancing

Provided by the advisor

Not available

Tax-loss Harvesting

Provided by the advisor

Not available

Personalized Investment Advice

Provided by the advisor

Not available

Let’s evaluate what are the advantages of each of the plans:

Advantages of Regular Plans

1. Professional fund selection process: It usually helps to trust someone who does something for a living. Selecting the appropriate set of investments from over 1,450 funds offered by over 45+ AMCs requires a lot of work and painstaking research. The advisor is usually equipped with industry-leading analytical tools that help them sift through vast troves of information and make sense of the data.

2. Portfolio Construction: Portfolio construction is a scientific-process that has been studied for many decades by leading researchers all across the world. Amongst other things, it involves not only studying individual investments but more importantly how these work and impact each other. A good advisor is able to construct a portfolio that is suited to your individual risk profile

3. Portfolio Rebalancing: Portfolio rebalancing is the process by which an investor’s portfolio is restored back to the original asset allocation. This is important to keep the portfolio in sync with your intended risk profile. A financial advisor will constantly monitor your portfolio and re-balance it as and when needed.

4. Advise and guidance: The 2-year market bull-run has made every investor look smart. Yet, we know that equity markets are inherently volatile. An expert would provide you with timely advise and guidance when markets go down.

Here’s a Tip:

Due to how the industry has come of age, a lot of the advisors and intermediaries are often focused on just pushing new investment products onto their clients without providing any ongoing support or value. If you are an investor investing in a Regular plan, you should definitely hold them accountable to the above.

Advantages of Direct Plans

1. Lower TER: Since Direct plans do not account for any commission/brokerage paid to third-party agents, these have a lower TER than Regular plans.

2. Higher return: On account of a lower TER, Direct plans deliver a marginally higher return to the investor.

Which is right for me?

If making money really just came down to a binary choice of Direct v/s Regular plan — everyone in fact would be reach. But clearly, everyone is not.

Hence, it’s not a question of this or that. Rather, it is about which of those plans is a better fit for your own needs. Direct plans are beneficial to individuals who have the time and knowledge to go through the entire investment process. However, if you’d rather channel your energy into doing your day-time job and enjoying your weekends, you are better off outsourcing this entirely to a professional at a small cost.

Here's another tip:

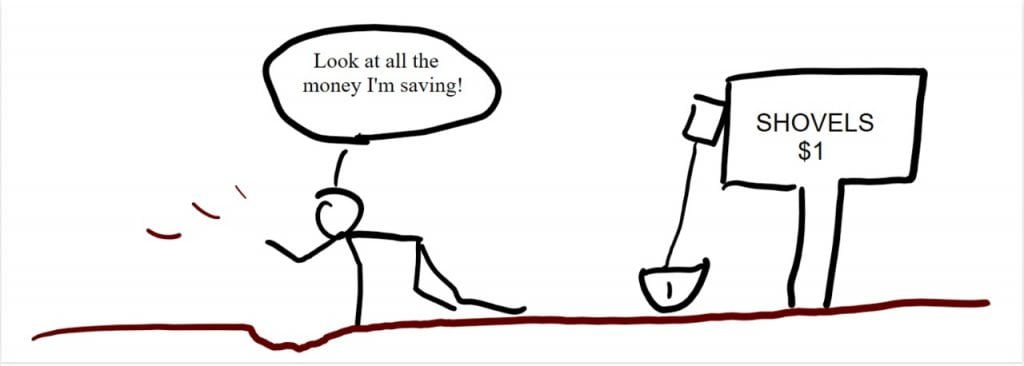

It is tough to escape the marketing campaigns of new investment apps encouraging everyone to invest in mutual funds via a ‘Direct’ plan or shift their holdings from a ‘Regular’ plan to the former. As if that is the supposed holy-grail of investing. So, next time you see advertisements luring you into the traps of ‘Zero Commission/Brokerage’ or ‘How commission is eating into your earnings’ – ask yourself this:

- Is this the right solution for me?

- Or am I being penny wise, pound foolish? In other words, by trying to save 0.5%-1% — am I taking uninformed decisions that will cost me much more in the long-term.

Yes, commissions do impact your overall returns. But, ignorance is more expensive. The choice is yours.