In today’s extremely volatile stock market, it can be a bit nerve-wracking to see your portfolio in red. After all, you had invested all this hard-earned money with an expectation that it’d eventually rise by the time you’d need it. Eventually. So, what happens in the interim shouldn’t really matter. Unfortunately, as humans, we are wired to make decisions based on short-term events. And therefore, inadvertently, we usually end up acting in haste – hoping that our active and continuous participation in the markets by buying/selling securities will either help in maximizing our returns or minimizing our losses.

No matter what you hear on the TV/Media from so-called ‘stock experts’ about when is a good time to enter/exit the market – it is nearly impossible to time the market accurately and consistently. The best advice is often to invest in a disciplined manner and stay put until your goals are achieved. Obviously, that does not mean that you stay invested in a stock/fund which has poor prospects or its underlying story has fundamentally changed – but that has more to do with security/fund selection criteria than market timing.

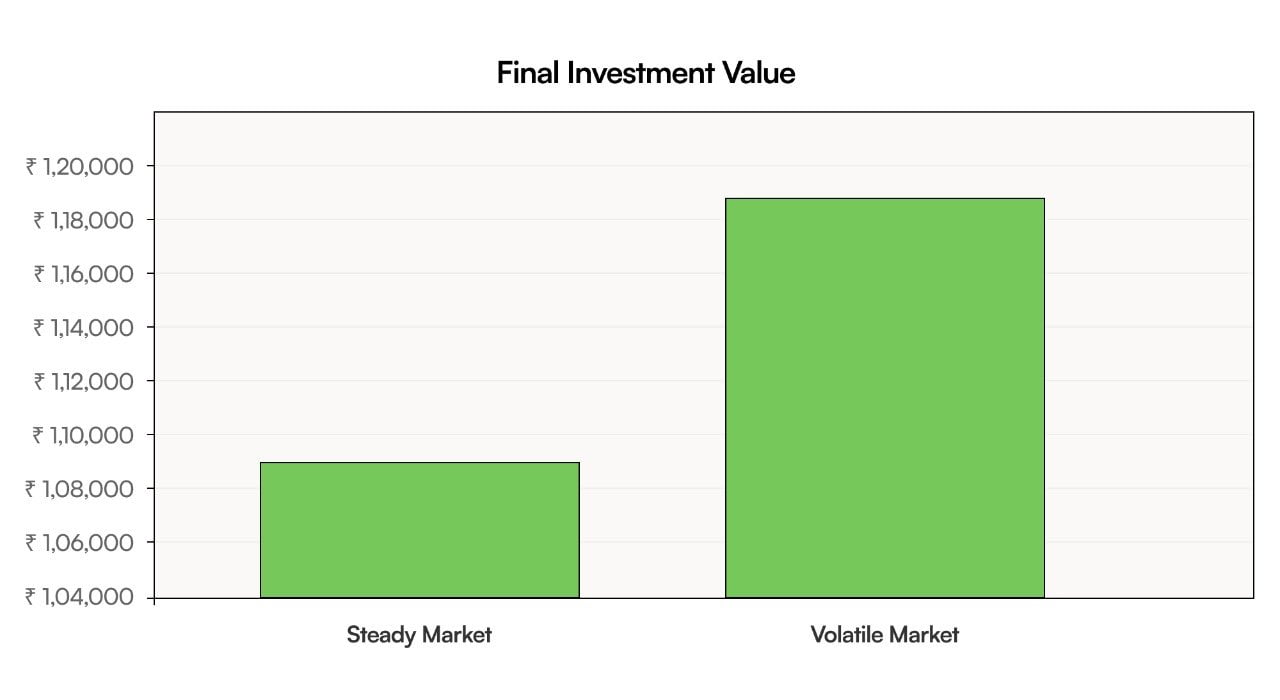

In this post, we will take an example of 2 different market scenarios to illustrate how you can make time work in your favour by investing and holding on to your investments in a volatile market (like the current one):

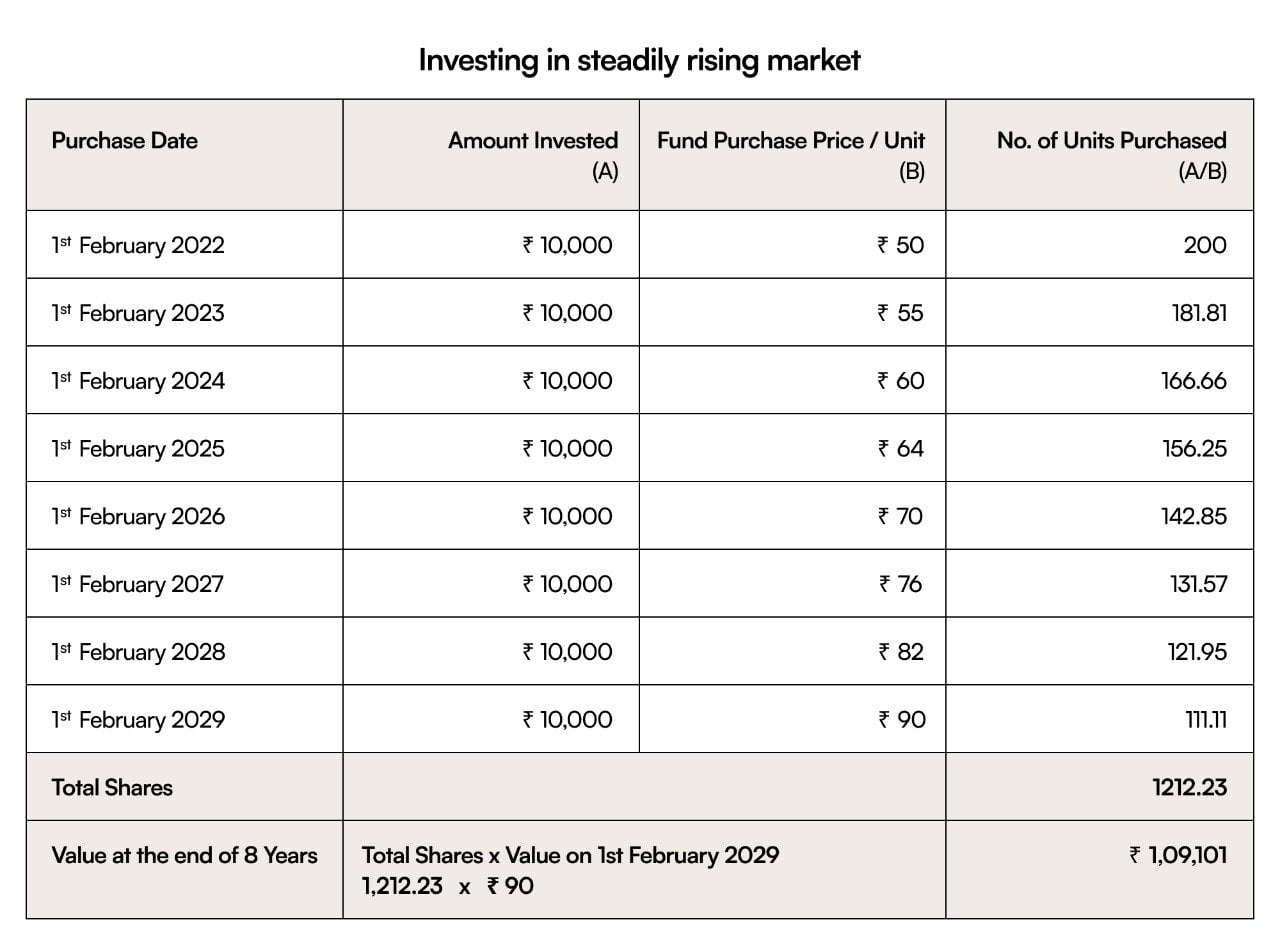

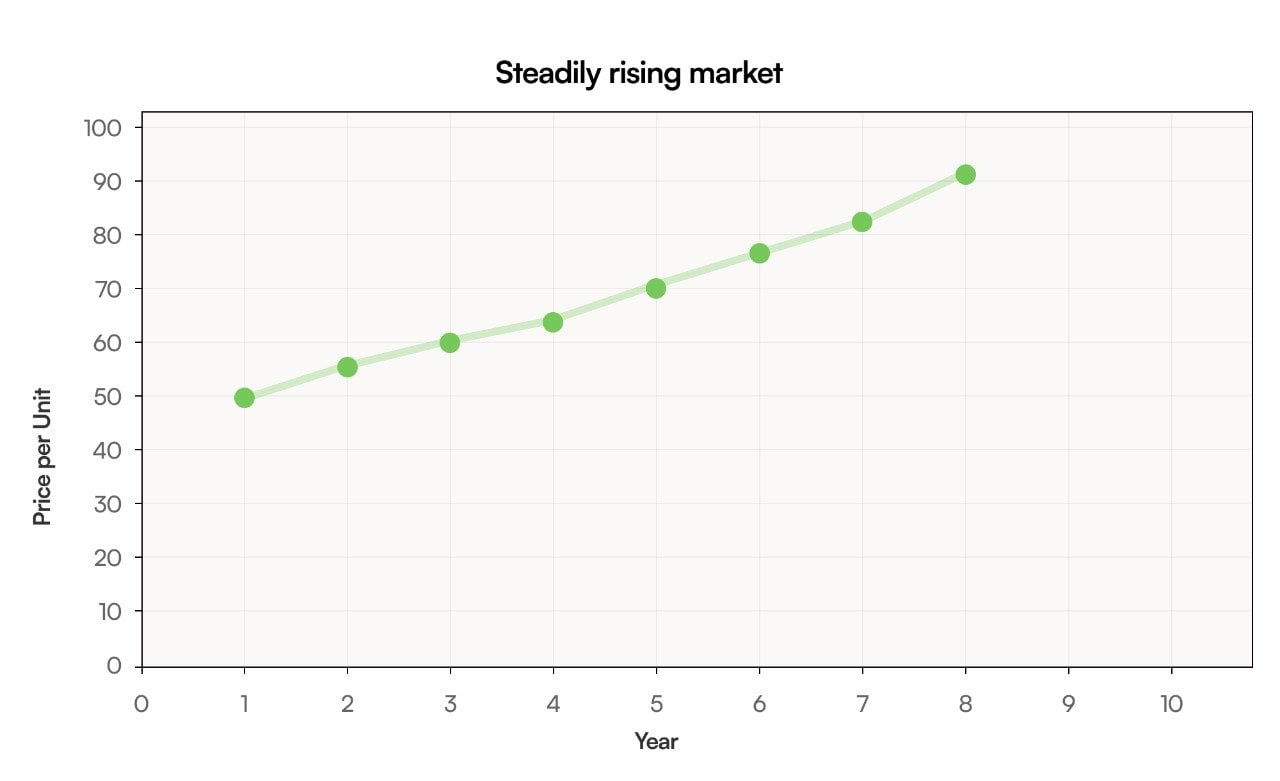

1. Investing in a steadily rising market

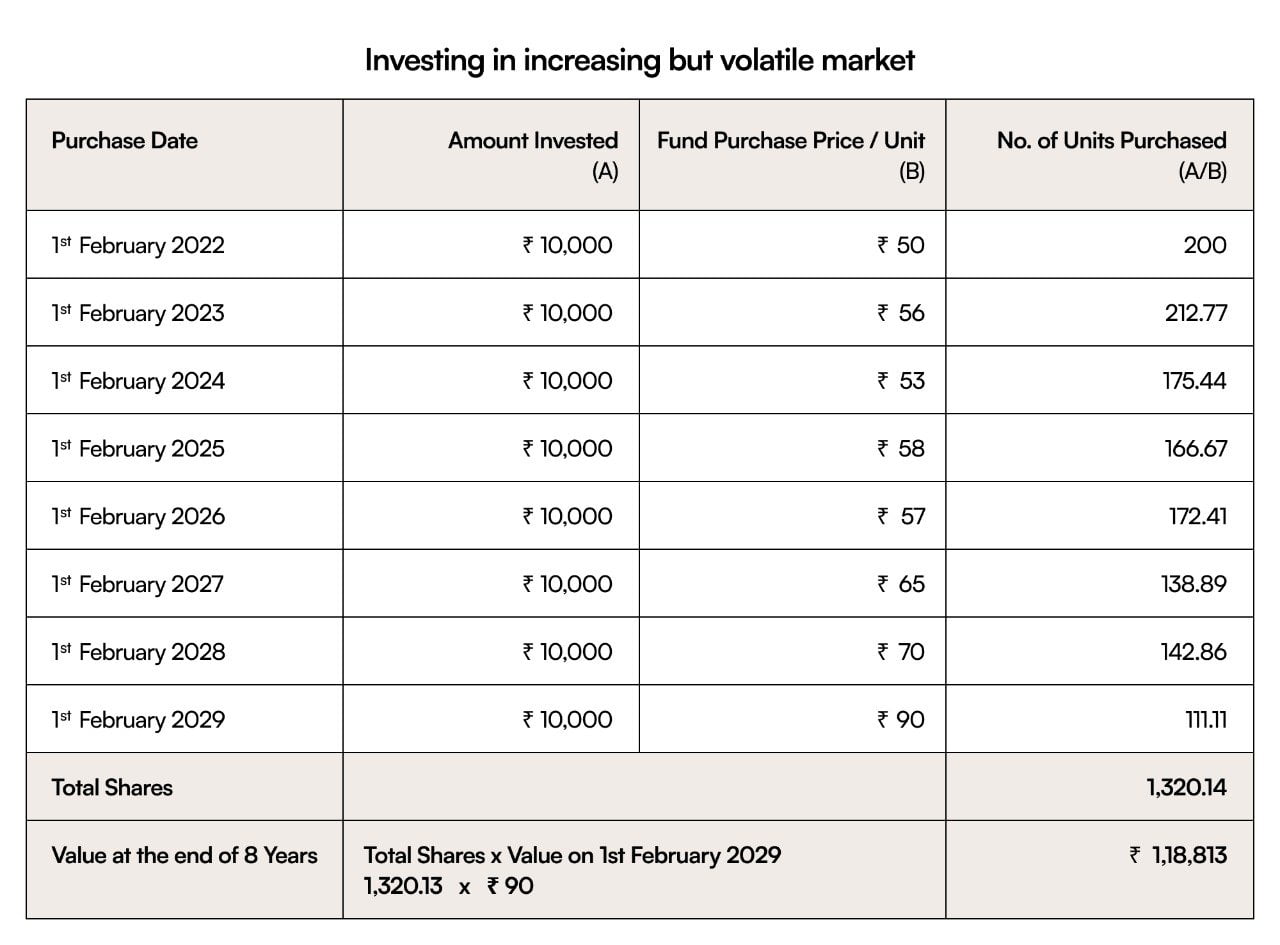

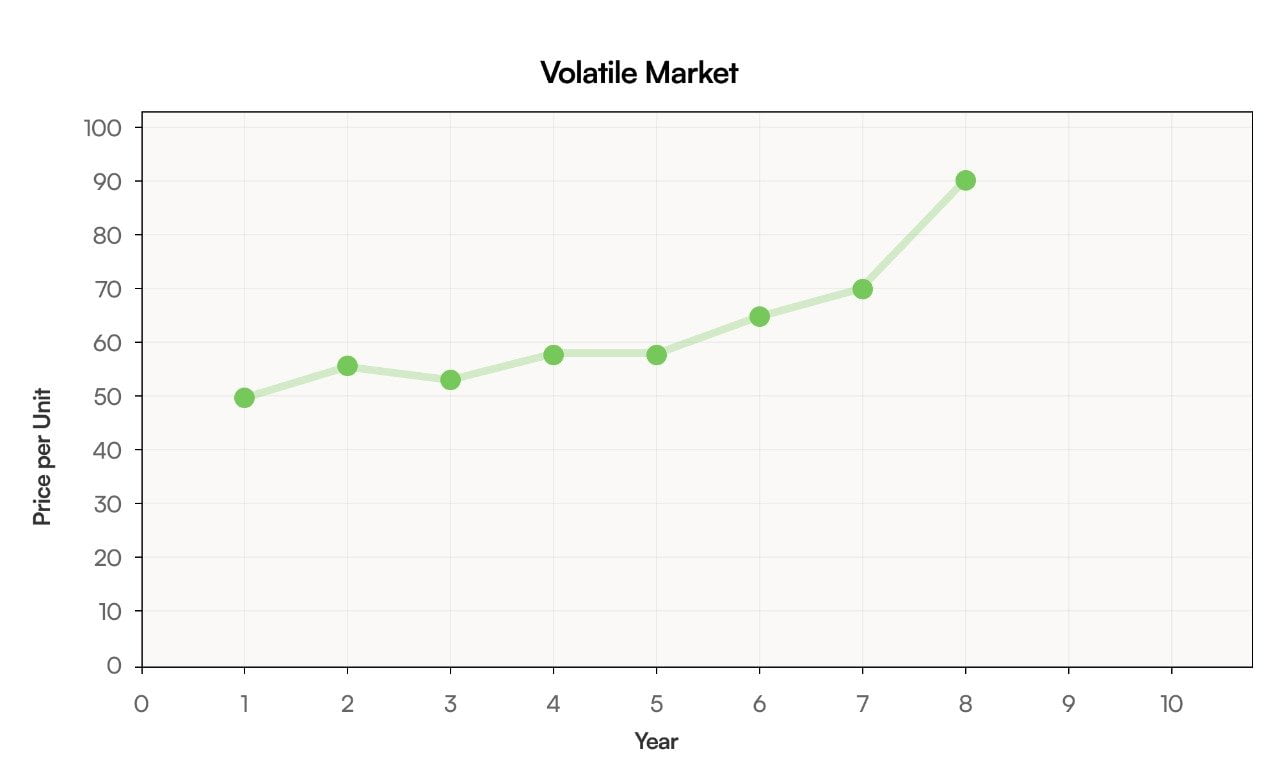

2. Investing in an increasing but volatile stock market

Final Results

As you can see in the graph below, investing in a bear or a volatile market leads to a higher value at the end of the 8th year. This is because one can purchase these investments at a relative discount due to market volatility. If you are investing for the long term (5 years and above), you can view the temporary downturn as an opportunity to purchase more for less (who doesn’t like that!).

Take advantage of the volatile stock market

The point we are trying to make here is that one can almost always be sure of generating a good return by simply staying invested in the market for the given duration of their goal – despite its ups/downs. And see short-term downturns as an opportunity to double down on your most high-conviction portfolios.

And do not forget the benefits of diversification

These periods are also a good time to truly see the importance of diversification — or spreading your investments across a range of asset classes i.e. equities, fixed income, international equities, and style i.e. large-cap, mid-cap, and growth. This ensures that you are not heavily concentrated on a single sector, company, or geography.

A study of the stock markets has shown that in the long term, it generally rises over time. A notional loss in the portfolio value can make you uncomfortable – but remember that loss is just on paper. You do not actually make a loss until you sell it for less than what you purchased it for. Do not take decisions based on what your friends/family are doing. And most importantly, do not hesitate to take professional help if required.

We hope that the post provided a good framework for contextualizing and thinking through the current market environment. Remember, it’s a blip! Enjoy the journey.

Don’t wait until it’s too late.

Start today and secure your future.