PMS vs Mutual Funds — This is a topic that confuses a lot of people. It can be challenging to decide which of the two to choose. Mutual funds and Portfolio Management Services (PMS) are both professionally managed investments where the portfolio is managed by a licensed fund manager. They assist investors in achieving their financial objectives and give them access to the capital markets (equities or debt). What makes the two different, then? The latter is open to everyone, but the former is only available to wealthy investors. Read on to learn more about PMS vs Mutual Funds.

What is a PMS?

A professional fund manager maintains your portfolio as part of a wealth management service called portfolio management service (PMS). Your money is invested in equities and securities by the fund manager following extensive market research. They either make independent investment decisions, obtain your approval prior to each transaction, or offer advice services but need you to carry out the transactions yourself. They offer their services in exchange for a fee, which is typically a cut of the earnings or a portion of the investment. The portfolio is also tailored by the fund manager based on your financial objectives, level of risk tolerance, and length of the investment.

What are Mutual Funds?

Investments known as mutual funds pool the capital of multiple investors and make stock and security purchases in accordance with the fund’s aim. Investors have no input in any decisions a fund manager makes about a portfolio because they are all taken independently. Prior to selecting the assets for the portfolio, they do in-depth market research and charge the clients a nominal fee. Mutual funds must disclose information on a daily and monthly basis and are controlled by the Association of Mutual Funds in India. Investors can choose from a variety of mutual funds on the market based on their financial objectives, the time horizon for investing, and the level of risk tolerance.

Advantages of a PMS

- Professional management: In PMS, your portfolio is managed by an accomplished fund manager. They know how to handle a portfolio in various market situations and effectively manage your investments to boost returns over time.

- Portfolio customization: Fund managers alter the portfolio in accordance with your objectives, degrees of risk tolerance, the time horizon for investments, and age. Before deciding on the securities for your portfolio, they will take all of this into account.

- Transparency: As a PMS fund investor, you have access to full details on every transaction. Additionally, you don’t need to wait for the fund house to provide reports on a monthly, quarterly, or semi-annual basis to know the state of the portfolio and its holdings.

- Regular monitoring: The fund management will keep a close eye on your portfolio’s performance. They will instantly change the portfolio if they discover any deviations.

Advantages of Mutual Funds

- Low entry threshold: You need only 500 rupees to begin investing in mutual funds. You don’t need to invest a lot of money in them.

- A variety of investment methods: You can use a systematic investing plan to make one-time or recurring investments in mutual funds (SIP). You can select one of the two alternatives based on your needs.

- Transparency: The fund house is obligated to routinely disclose the portfolio holdings, expense ratio, and net asset value (NAV). Your investments will be transparent as a result.

- Diversification: By investing in a single mutual fund, you can access a wide range of equities and assets. This makes sure that the various securities in your portfolio are well-diversified.

- Professional management: It is used when managing mutual funds. They are well-versed in their disciplines, have a wealth of expertise, and know how to manage a portfolio in various market conditions.

PMS vs Mutual Funds: The differences

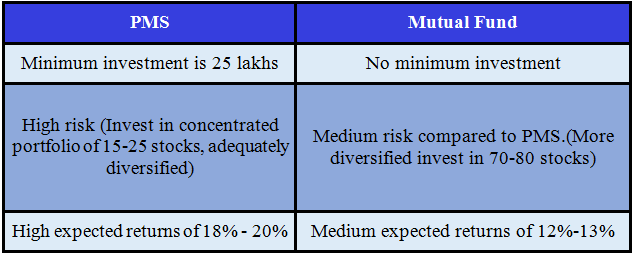

The following are the key distinctions on pms vs mutual funds:

Investment amount

While the minimum ticket size for PMS is Rs. 50 lakhs, the minimum investment amount for mutual funds is Rs. 500 through SIP. Therefore, unlike PMS funds, mutual funds are readily available to all investors.

Fees

Investors in mutual funds are subject to a predetermined fee that is deducted from the fund’s net asset value (NAV). There are no taxes due by investors on specific transactions.

In contrast, PMS employs a hybrid structure where it charges a fixed price and also takes a portion of the earnings. It also charges a performance-based fee by taking a cut of the profits.

Professional leadership

In mutual funds, which are professionally managed investments, a knowledgeable fund manager chooses the stocks and other securities for the portfolio after conducting extensive market research. Investors have no influence over the portfolio, and the managers choose the stocks based on their assessment.

Before making any investments in PMS funds, the fund manager consults the investor. Sometimes they operate autonomously and decide everything related to investing only after receiving investor consent. The majority of the time, investors must, however, approve every transaction.

Flexibility in the portfolio

Despite severe market conditions, mutual funds are required by law to maintain their equity and debt asset allocations. For instance, a fund can only be considered an equity fund if 65% of its assets are allocated to stocks. The fund manager cannot reduce the equity asset allocation in a volatile market to sustain performance.

Depending on the state of the market, the fund manager may alter the asset allocation in PMS funds.

Individualized portfolio

An investor’s needs cannot be accommodated by a mutual fund portfolio. This is such that personalization is not possible when there are several investors in a mutual fund, which pools money from a number of investors.

According to the investor’s objectives, level of risk tolerance, age, investment horizon, and available resources, the fund management tailors the portfolio in PMS funds.

Transparency

All information pertaining to mutual funds must be published on a regular basis. Thus, before investing in a fund, investors can examine its returns, costs, and portfolio.

The fund’s information in PMS is not accessible to the general public. All information about the fund and its transactions is only visible to the investor. As a result, it can be challenging for investors to contrast two PMS funds before selecting one.

Taxation

Investors in mutual funds only pay tax on their investments when they redeem them. Depending on whether the gain is long-term or short-term, the tax is applied.

Investors must pay tax on each purchase and sale of stocks when investing in PMS funds, though.

Documentation

Mutual funds are well-liked investment options that might be bought with no paperwork from the fund corporation or any site that provides them. However, because there is so much documentation required, investing in PMS funds is far more difficult. The procedure of creating a PMS account takes time as well.

Conclusion

You can invest in stocks through mutual funds as well as PMS funds. However, it’s crucial to choose which one best suits you at what time. If you have limited resources are getting started with investing for the first time and want the convenience to invest regularly, mutual funds can be the ideal option for you. If you have complicated financial needs and at least Rs 50 lakhs, you can consider a PMS. However, always consider the tax implications of both options and choose the one that best meets your goals, wants, budget, and requirements based on the advantages and differences listed above on pms vs mutual funds.