What Is An IPO?

An Initial Public Offering or IPO is a privately held company’s debut as publicly-traded security on a stock exchange. The issuing company or firm raises capital through the primary market. Once the IPO is complete, public investors can trade shares on the secondary market.

IPO issuing firms raise more capital than they would as a private company by offering shares to the public. From an investor’s perspective, these IPOs like the LIC IPO, offer an opportunity to buy shares of a company that can grow into a larger and more profitable Company.

LIC IPO

The Life Insurance Corporation of India (LIC) has applied with the market regulator – SEBI – for its much-anticipated initial public offering (IPO) and wants to sell 5% of its stock through an offer for sale (OFS). According to LIC’s Draft Red Herring Prospectus (DRHP), filed on February 13, the insurance giant’s embedded value is Rs 5.39 lakh crore. LIC has become a household name and currently has nearly 29 crore policyholders. LIC has a 64.1% market share in terms of premium and 66.2% market share in terms of new business premium.

Furthermore, the administration, which owns 100 percent of LIC, intends to offer policyholders a premium in the IPO. The government has not yet confirmed the extent of the issue, but it is expected to be announced soon.

When Is It Coming?

The IPO of LIC was expected to open in March, however with the evolving geo-political situation the government is yet to decide on the exact timeline. An IPO usually takes 4 to 6 months to complete. With the support of consultants, the government has already met a long list of operations in the pre-IPO phase, including agreeing on the timetable for the IPO, company valuation, creation of revised financial information, DRHP, offering to file, finalizing IPO details, and so on.

Price of LIC IPO

The price of the LIC IPO has yet to be announced. The Government of India will decide the IPO issue price and discount to retail and employees a few days before IPO opens. The issue price could be between Rs 1,693 to Rs 2,962 per share. Face value for LIC IPO is Rs 10 per equity share.

LIC IPO for Policyholders

Budget officials announced in the 2022-2023 fiscal year that up to 10% of the LIC IPO share capital would be designated for policyholders. On the other hand, experts believe that the launching of LIC will indirectly help policyholders. The offering of LIC will improve openness and administration in its operations because it will be required to comply with all SEBI listing criteria, hence increasing its efficiency. Furthermore, LIC policyholders may be given a protected quota in this IPO.

PAN Details for LIC IPO

For Update

- Visit https://linkpan.licindia.in/UIDSeedingWebApp/getPolicyPANStatus to check the status of your policy.

- Enter your Policy Number, Date of Birth (dd/mm/yyyy), PAN, and captcha in the appropriate boxes. After that, click Confirm.

For Linking PAN for LIC IPO

- Visit the official LIC website at https://licindia.in/ or the direct page at https://linkpan.licindia.in/UIDSeedingWebApp/.

- Pick the ‘Online PAN Registration’ tab from the home page if you’re on the web page.

- Tap the ‘Proceed’ button at the bottom of the Online PAN Registration page.

- After that, input your date of birth, gender, email address, PAN, full title as per PAN, cellphone number, and LIC id number on the new page.

- Select the declaration checkbox from the drop-down menu.

- Request an OTP from your registered mobile number.

- When you get your OTP, enter the digits into the site and submit.

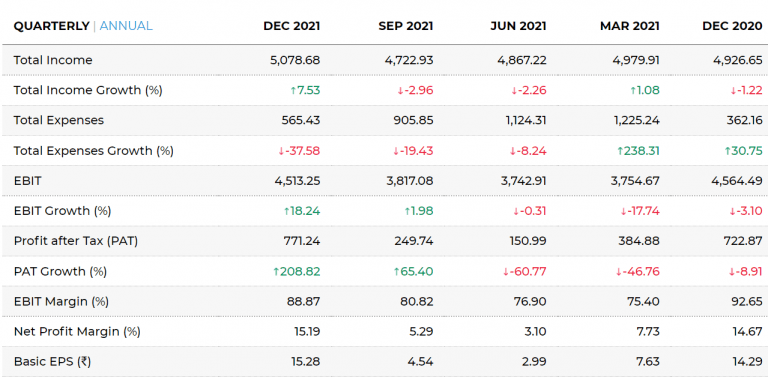

Current Finances for LIC IPO (in crores)

Apply For LIC IPO

Given the LIC IPO craze engulfing the country, many individual investors want to get in on the action. Using their Unified Payment Interface (UPI) ID is one of the ways individual investors can bid for shares in the IPO. Only individual investors, eligible workers, and eligible policyholders can use the UPI method, according to the LIC DRHP published with SEBI.

Eligible consumers bidding in the Policyholder Allocation Portion can use the Condition Related by Blocked Amount and UPI Mechanism. Interested retail investors must confirm the UPI mandate request before bidding through the UPI Platform.

The following are the Do’s and Don’ts to follow when bidding for an IPO using UPI, as per LIC DRHP:

- Do not fill out the Bid Cum Application Form with a third-party bank account or a UPI ID connected to a third-party checking account.

- If RIBs are bidding using the UPI Mechanism, do not upload one Bid cum Registration Form for each UPI ID.

- Since you’re a RIB, Eligible Client, or Eligible Covered entity bidding through to the UPI Method, do not enter incorrect details for the DP ID, Client ID, PAN, and UPI ID.

- To apply for the Offer, they must utilize only their ASBA Account or bank account linked to UPI ID, not the ASBA Account or bank account related to the UPI ID of any third person.

- Investors that use the UPI Mechanism should only mention the Bidder’s and the first Bidder’s valid UPI IDs.

Don’t wait until it’s too late.

Start today and secure your future.