To say that some of the world’s biggest hedge funds have had a disastrous year would be an understatement. Such has been the magnanimity of the losses, that funds such as Tiger Global have lost over two-thirds of its cumulative gains since its launch in 2001.

Before we look at the performance, let’s first understand what exactly are these.

What are Hedge Funds?

Hedge Funds are investment vehicles that use sophisticated investment strategies to generate alpha i.e. beat the market index. They typically cater to big investors like pension funds, high net-worth individuals, university endowments etc. Individual investors often have very limited access to these funds because of the inherent risk associated with their investment strategies.

In their true sense, hedge funds are expected to do well in all market conditions irrespective of a bull/bear market. This is because traditionally they have followed what is called a ‘long-short’ strategy.

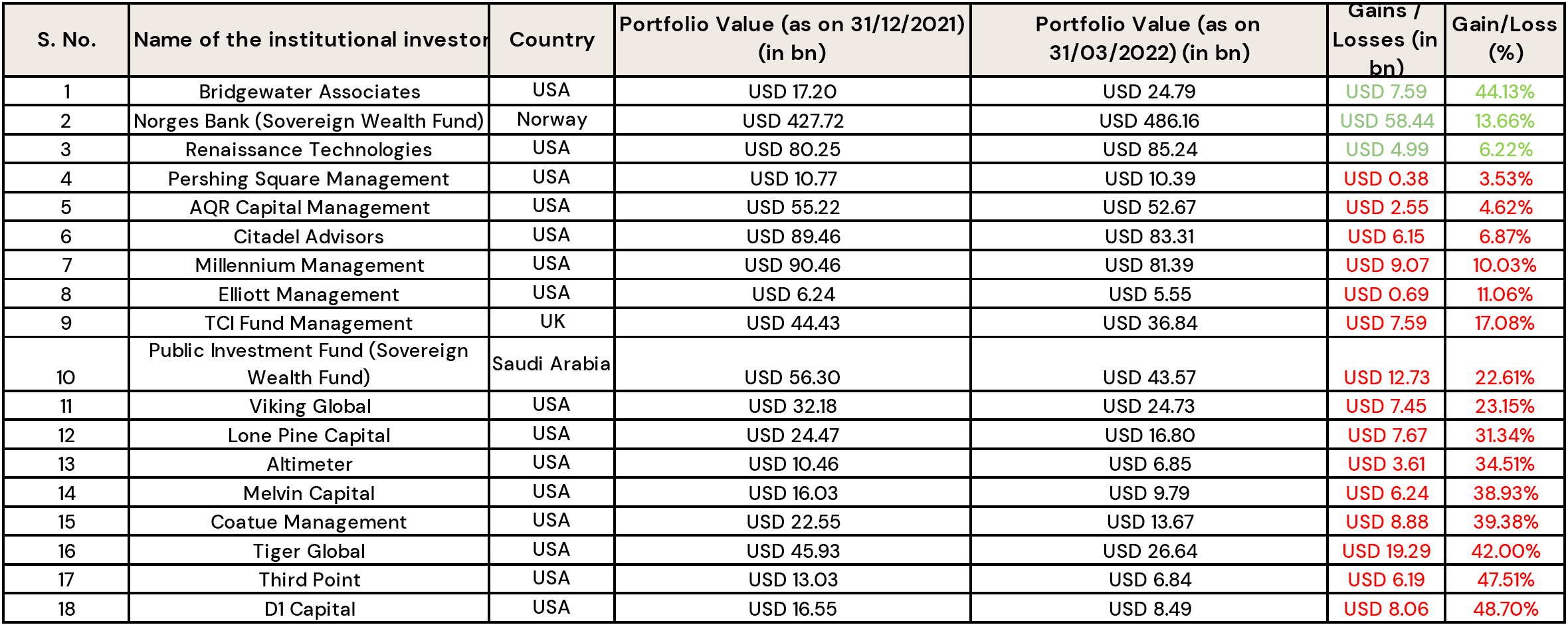

Below, we list the performance data of some of the prominent hedge funds that were down in Q1 2022. The data has been compiled using the most recent 13F filings of these investors:

As we can see from the table above, only 3 of the big names i.e. Bridgewater Associates (Ray Dalio), Norwegian Sovereign Wealth Fund and Renaissance Technologies (Jim Simmons) have posted gains despite a broader market drop. Rest almost all of them have fallen more than the benchmark indices i.e. S&P500 (-4.9%) and Nasdaq 100 (-8.9%).

Hedge Funds, by definition, are supposed to fall less during a downturn because their positions are, well, ‘hedged’. Yet, we see most of these investment vehicles have mostly transitioned to operating a ‘long-only’ fund. In other words, they bet on the upward movement of the stocks.

A lot of these funds are heavily skewed towards technology stocks which have taken the maximum beating in the current market downturn.

No matter how much one professes of accurate timing or beating the market, the proof of the pudding is that it is difficult to do it consistently — especially in a highly volatile market like now.

“Markets have not been cooperative given the macroeconomic backdrop but we do not believe in excuses and so will not offer any

Tiger Global

So, if are getting nervous looking at your portfolio — you can perhaps take solace in the fact that you are not alone. And that we will look back at this moment as just a point in time over the longer arc of our investment journey.

Don’t wait until it’s too late.

Start today and secure your future.