A mutual fund scheme that adjusts its asset allocations (equity or debt) based on current market conditions and trends is known as a dynamic asset allocation fund or balanced advantage fund. These funds employ an asset allocation strategy where they tweak the investments in securities depending on the conditions of the market. Dynamic mutual funds act as a shield against downswings in the market and they usually lose substantially less amount of money during a time when the markets are down. Hence, these funds are believed to be an ideal investment avenue in the volatile market that seems to be on a bull run.

Purpose of Dynamic asset allocation

It is perhaps the best and most well-suited investment vehicle in an irregular market. As opposed to static allocation funds, the dynamic funding mechanism is a better option because the investments are widely spread out and can be altered as and when needed.

A dynamic asset allocation perspective means that whenever an investment class is underperforming, the money can be shifted to other assets that stand to gain the most from the given market conditions.

The built-in dynamic nature of these funds is their primary advantage. It is a mechanism to beat off the market slumps and adapt according to the situation.

The balanced funding option is highly recommended for those who are looking for assured returns after the end of their tenure. It is also a valuable asset to those who have limited funds to invest in multiple sectors. Above all, dynamic asset allocation Mutual Funds are preferred for their steady and recurring returns.

Dynamic Asset Allocation funds vs Balanced mutual funds

Many investors tend to confuse dynamic asset allocation or balanced advantage funds with balanced hybrid funds which also invest in a combination of debt and equity securities. However, both of these funds differ in many aspects and the differences are as follows :

- A balanced hybrid fund invests in a mix of debt and equity securities where the proportion is usually 35% in debt and 65% in equity. In a dynamic fund, the exposure to equity and debt can go up to 100%, depending on how the market plays out.

- Unlike balanced hybrid funds, dynamic asset allocation funds can switch their asset allocation which aids in riding out the market volatility and can minimize losses.

- Dynamic asset allocation funds are much more flexible as they can juggle between asset classes as compared to balanced funds which have a fixed asset allocation ratio with which they have to invest capital.

- Balanced hybrid funds carry a relatively higher risk than dynamic asset allocation funds.

Taxability

Since these funds usually have an average equity exposure of 65% or more, they are taxed as equity mutual funds. This means that while short-term (less than 1 year) gains are taxed at 15%, long-term gains (investments sold after 1 year) are taxed at a mere 10%. More importantly, only long-term gains in excess of Rs. 1 lakh are taxed at a rate of 10%. Thus, if you sell your investment in 2 years and make a profit of Rs 1,10,000, you would only pay 10% tax on Rs 10,000.

Extremely safe in nature

One of the best things about this fund is the way in which these investments are designed. Equity investments are made based on the fund manager’s equity outlook and other pre-determined investment criteria and analysis. Thus, when markets are going up, the equity investments increase so that you can reap the maximum benefit of rising equity prices and make huge gains. Now, if the markets start falling, the fund manager has the ability to pare down the equity investments in the portfolio and start buying debt investments. This way, the portfolio downside is very well-protected and you don’t need to worry about finding the right time to invest in equity markets.

Focuses on Asset Allocation

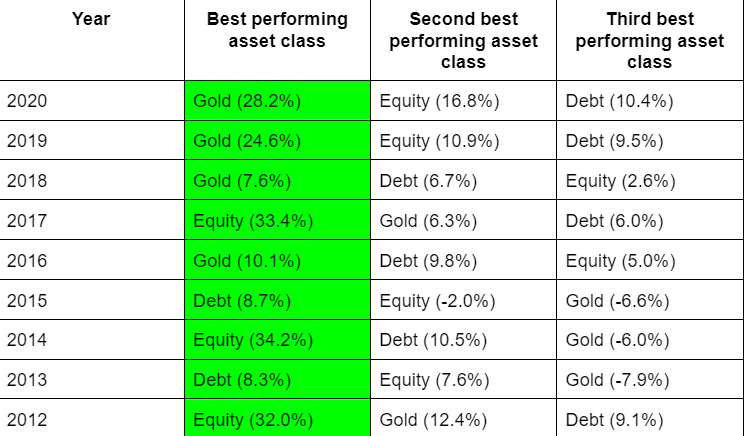

The main reason for the success of this fund is its focus on asset allocation as an investor you don’t know which asset class is going to perform better in the coming years. Having an asset-allocation-defined portfolio ensures that the fund manager can oscillate between different asset classes. The below table makes it amply clear that different asset classes outperform in different years. For e.g. Gold beat equity and debt over the past 2 years due to the volatility in the markets. Hence, having a mix of multiple asset classes in your investment portfolio is essential. As a result, there can be a considerable variation in the number of returns by two different asset classes in the same year.