A Core and Satellite Investment Portfolio is a systematic and disciplined portfolio-building technique that has gained ground in recent years.

Investors like you today seek predictable and consistent results in an increasingly uncertain environment. We believe the only way to achieve that is by being guided by a disciplined investment approach.

In India, a common trend is focusing on individual, high-performing funds. However, by evaluating them in isolation and accumulating a hodgepodge of them, you expose your portfolio to unintended risks. We believe to create optimal solutions suited to your risk profile, financial profile and unique life situations — one needs to take a holistic approach.

Our multi-fund solutions are all research-driven, from macro research that drives our asset allocation to underlying fund research that informs what building blocks we use to implement our portfolios. We use the most advanced analytical tools available in the market that help us rigorously back-test your portfolios on a wide variety of scenarios.

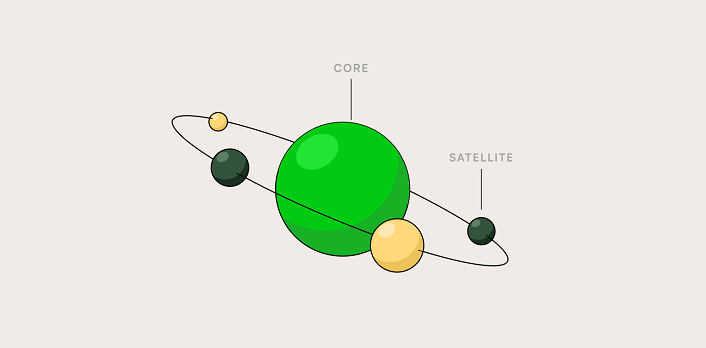

Core

Let’s start with Core investments. The ‘core’ of each asset class is the exposure designed to track the overall performance of the index with very low levels of portfolio turnover. It consists of low-cost, diversified, passive products. For e.g. An Nifty50/S&P BSE Sensex index fund/ETF can form the ‘core’ portion of your equity allocation while a short term debt fund can form the ‘core’ of your fixed-income allocation.

Satellites

‘Satellite’ positions consist of actively managed funds that seek to outperform the broader market/index. These positions provide the overall portfolio alpha by increasing the risk-adjusted returns. For e.g. A small/flexi-cap fund can ‘satellite’ your ‘core’ positions by diversifying exposure and increasing the opportunity to seek enhanced performance.

Thus, a Core-satellite portfolio strategy has the ability to give a boost to your investment returns without hampering or changing the direction of the goals you were aiming to achieve.

In the next post, we shall talk more about our portfolio-construction technique to get an in-depth understanding of our methodology.