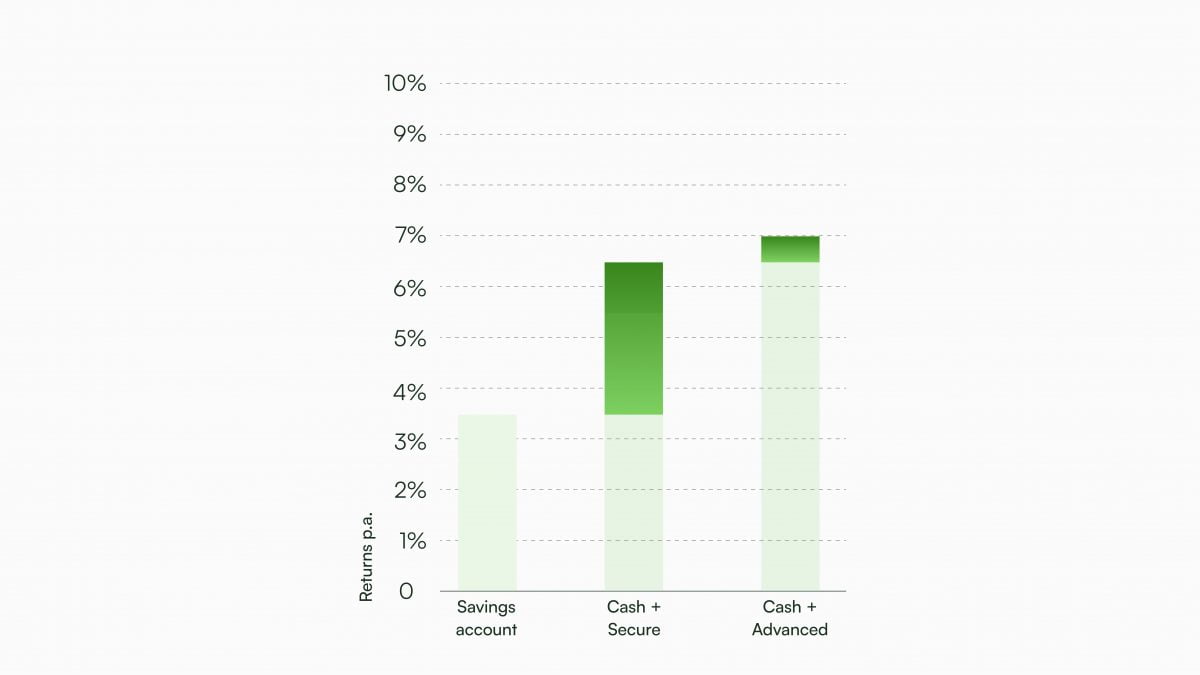

Cash Management solutions from banks are boring and do no better than the 3-4% that you earn on your savings account balance. We are out to change that. Daulat was started to provide relevant solutions for all of your wealth needs. We launched with our flagship advised portfolios – Daulat Multi-Asset Solutions (‘DMAS’) – which proved extremely resilient during last year’s market volatility. These portfolios are built using time-tested investing principles and designed to create long-term wealth for you.

However, we constantly heard from our clients that they were looking for better solutions for their short-term cash goals than what their savings/current account offered. We couldn’t agree more. Letting your cash sit idle in a bank or a fixed deposit – while easy and convenient – is not the most efficient way of parking your money.

So, today, we are introducing Cash+ : our new and innovative cash management solutions for individuals and corporates.

What is Cash+?

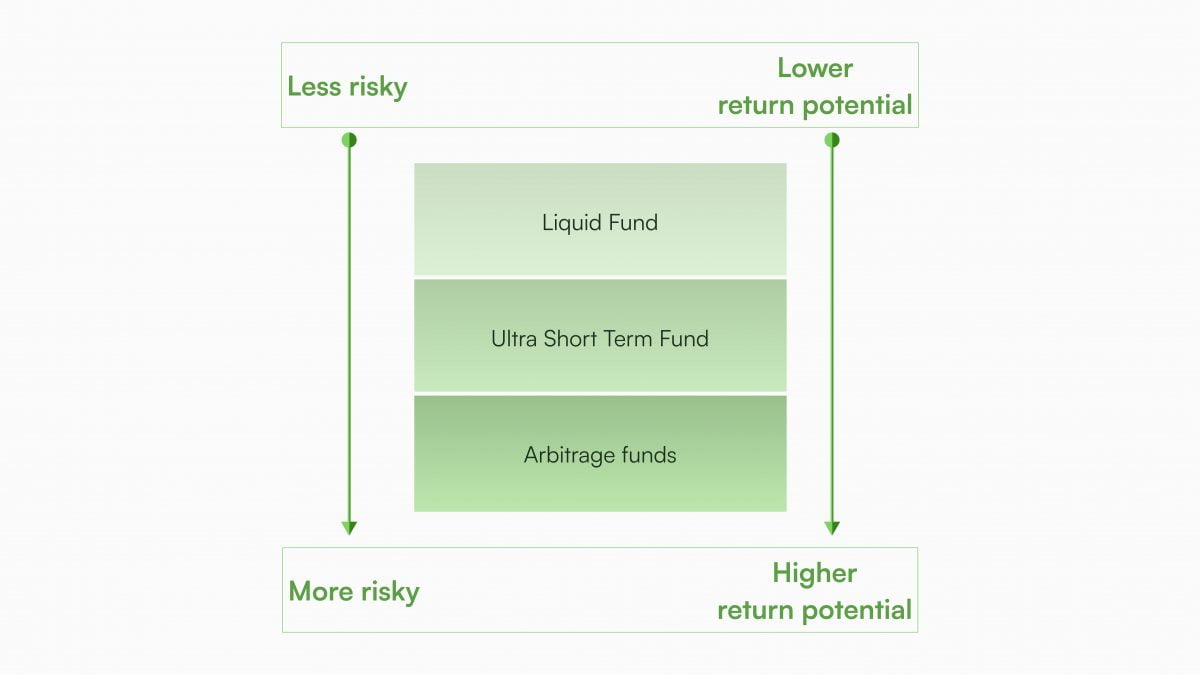

As we transition away from a period of ultra-low interest rates, the banks are still stuck at providing a 3-4% interest on your savings account. We think you deserve better. Cash+, as the name suggests, lets you earn higher returns than the cash sitting in your bank account. By investing in a combination of liquid, ultra-short term, and arbitrage mutual funds – depending on your risk appetite — these portfolios are a better alternative to your existing solutions.

Traditionally, we have resorted to putting our money away in our savings account because it’s liquid i.e. one can take it out whenever required and it preserves our capital i.e. we know that we will at least be able to take out the principal amount or how much we have put.

Both of the above characteristics – liquidity and capital preservation – are also at the heart of our Cash+ portfolios. We recognize the need for both of these characteristics and thus have carefully curated funds to ensure you can have your money whenever you want it.

Where will my Cash be invested?

These short-term debt and arbitrage mutual funds portfolios invest in securities like certificates of deposits (CDs), commercial papers (CPs), and bonds issued by central/state governments and corporations. Just like how when you put your money with a bank — the bank in essence then lends that money forward to thousands of different borrowers whether individuals or companies. Similarly, when you invest in a Cash+ portfolio — your money is effectively being lent out to many different companies. All these companies are assigned a credit rating — which measures the riskiness of the debt issued — and the Cash+ portfolios only invest in funds that invest in companies with the highest and the best credit ratings.

Risk

Cash+ portfolios are investment products, not bank deposits, inherently carrying a certain level of risk. We acknowledge that and effectively manage the risk by investing in the best funds that invest in the highest-quality assets like AAA bonds issued by the Government of India, PSUs, and blue-chip companies like Reliance, Tata etc.

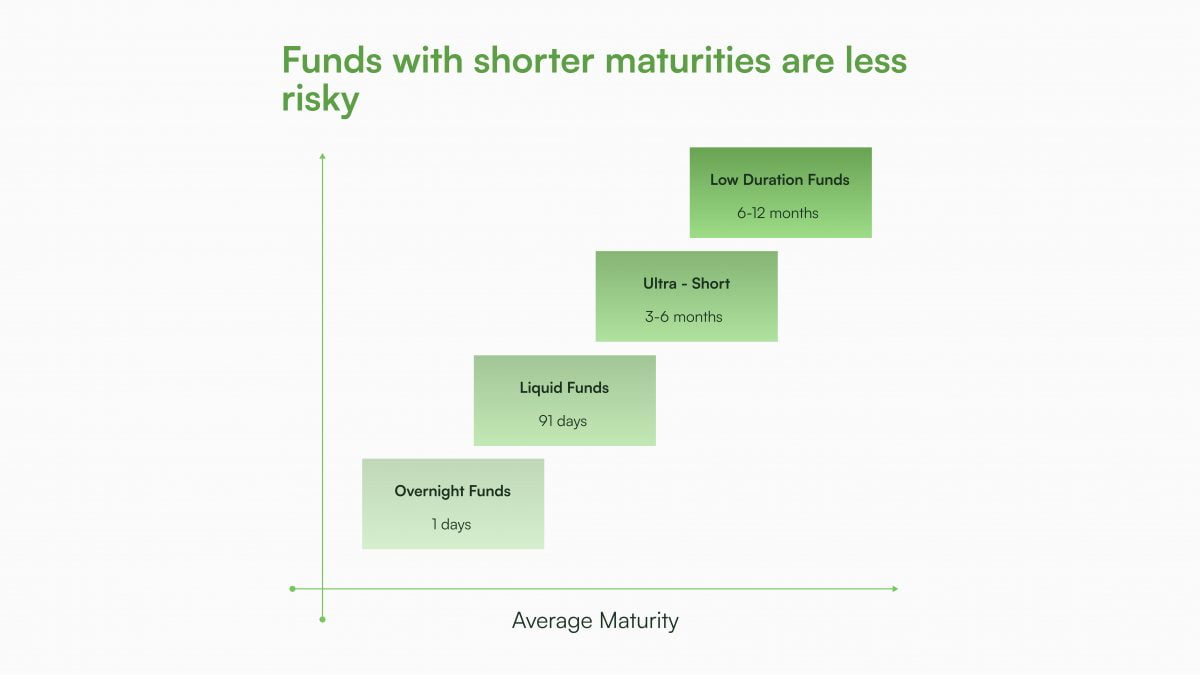

These funds further invest only in short-duration instruments because they are less risky than long-duration bonds. Put simply, bonds with shorter maturity i.e. 1-6 months are less risky than longer maturity bonds because they are less exposed to any interest rate risk.

Liquidity

Liquidity is a priority when considering which funds to invest in and how we construct portfolios. All our portfolios are redeemable with no lock-ins and penalties. The money gets credited directly to your bank account in T+1 working days.

No filling out any form, doing additional paperwork or sending us any documents. Take advantage of our digital platform and put your cash to use instantly. And redeem whenever you want — no questions asked! After all, it’s your cash.

Returns

Cash+ portfolios offer significantly higher yields than your savings bank account while providing the benefits of liquidity, safety, and capital preservation. The current yield-to-maturity of our two Cash+ portfolios are:

a. Cash+ Secure: 6.5% – 7.5% per annum

b. Cash+ Advanced: 7.5% – 8.5% per annum

However, please note that the estimated returns are based on the current yield-to-maturity of the debt portfolio and indicative historical returns from the arbitrage funds. There is no guarantee that such returns will be sustained in the future in an evolving macro-economic environment

Is it for me?

If you are looking to save for an upcoming expense in the next 6-12 months. Or simply want to put your money away before you start investing, then this is definitely for you.

It is an even better options for coprorates like private limited companies/LLPs who earn 0% on cash sitting in their current account. We can create customised treasury portfolios for you to meet your liqudity needs.

So, what are you waiting for? Speak to a wealth expert today or write to us at hello@daulat.co.in. And don’t let your cash sit idle.

Invest with Cash+ and earn better than your bank account/fixed deposit.