The past decade has been characterized by the rapid growth of technology companies. These companies, often unprofitable, became the darling of investors on the promise of higher-than-average revenue growth.

Indian investors warmed up to these Growth stocks in the past year with the listing of companies such as Zomato, Paytm, Nykaa, etc. But what exactly are they and how are they different from the other end of the spectrum i.e. Value stocks? Let’s find out the difference between Growth vs Value stocks.

What are Growth stocks?

Growth stocks are typically companies that are growing at a fast pace and have relatively higher valuations as measured by the price-to-earnings ratio or price-to-book value ratio. These companies are more focused on user acquisition and revenue growth than near-term profitability and therefore their earnings tend to occur far out in the future.

Investors continue to flock to these stocks and ascribe them to high valuations as long as they can demonstrate growing market share and revenue growth. However, any signs of a slowdown or a decrease in growth can cause their stocks to come crashing down.

E.g. Share price of Netflix crashed by almost -40% after it reported a loss in its subscriber numbers.

Examples of Growth stocks: Adani Gas, Adani Green, PolicyBazaar, Paytm, Nykaa (*these are not stock suggestions)

What are Value stocks?

Value stocks by comparison are associated with mostly ‘boring’ companies. Technically, stocks that are currently trading at a lower price or are valued cheaply compared to their actual intrinsic value. These are stable companies that produce strong cash flows and steady revenue growth. And are mostly favoured by investors who are seeking a dividend income.

These stocks are less risky than growth stocks as they have a proven and a stable business model.

E.g. Large Indian IT firms such as TCS, Infosys, Wipro and banks such as HDFC Bank, Axis Bank fit into the above criteria of being ‘cheap’ compared to their actual worth and paying steady and consistent dividends to their shareholders.

Growth vs Value – Differences

| Parameter/type | Growth Stocks | Value Stocks |

| Volatility | High | Low |

| Holding period | Low | High |

| Dividend expectations | Low | High |

| P/E ratio | High | Low |

| Criteria to choose | Earnings primarily through capital gains | Earnings primarily through steady dividends |

Where are we in the current market cycle?

Growth stocks tend to perform the best in a low-interest rate regime. In an inflationary environment (like the current one) – an upward-trending interest rate tends to lower the current value of the future cash flows thus making the growth style less appealing than the value style. This follows the notion that the value of an asset (shares or anything) is nothing but the discounted value of future cash flows.

Investors have now instead turned their focus on companies that produce robust cash flows and reward them with consistent dividend payouts.

Where should we be invested then?

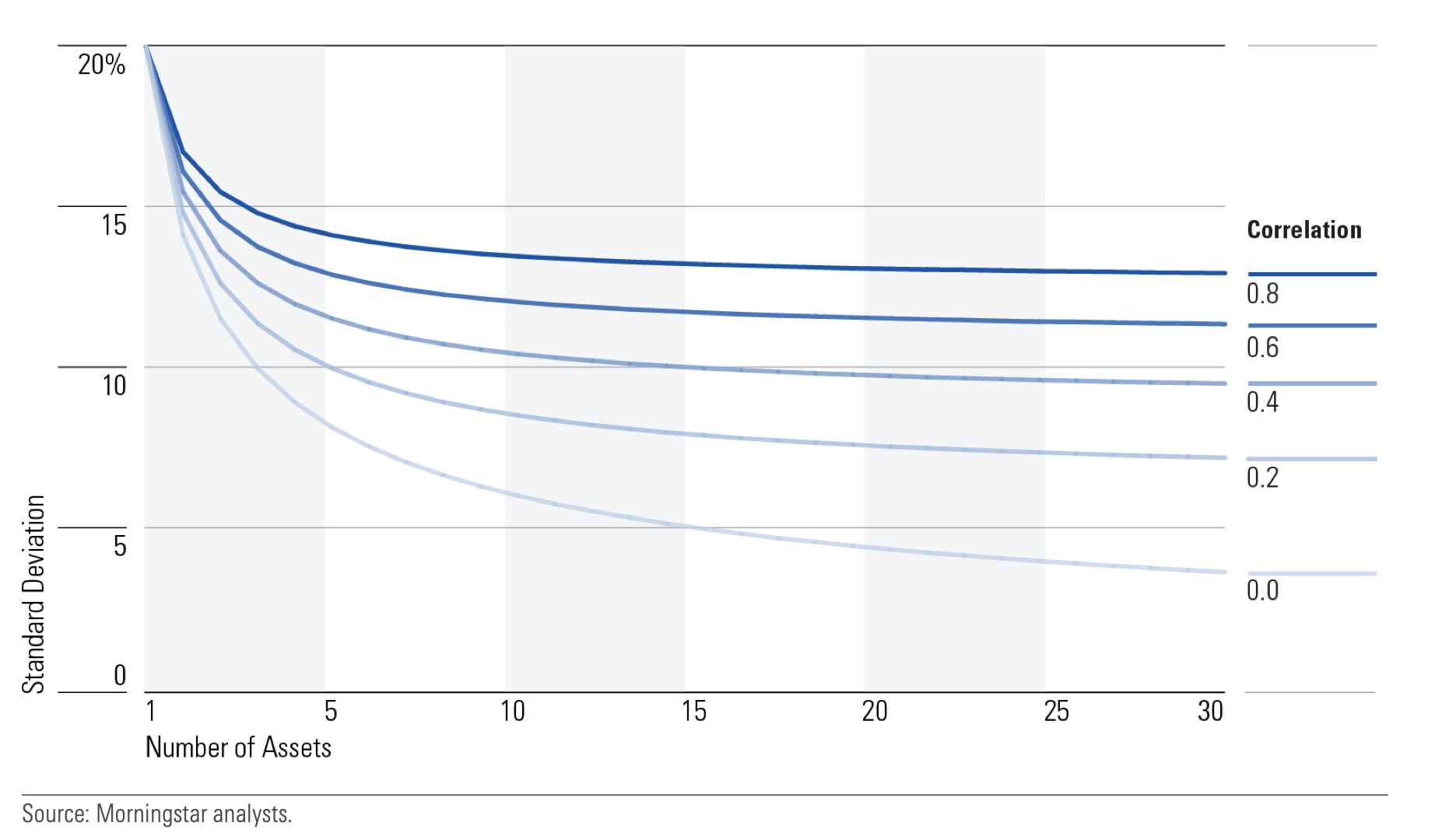

We typically do not believe in a ‘this-or-that’ approach. Rather, we feel that both these styles of investing have their strengths and weaknesses and that investors should have appropriate allocations to both of them per their risk appetite.

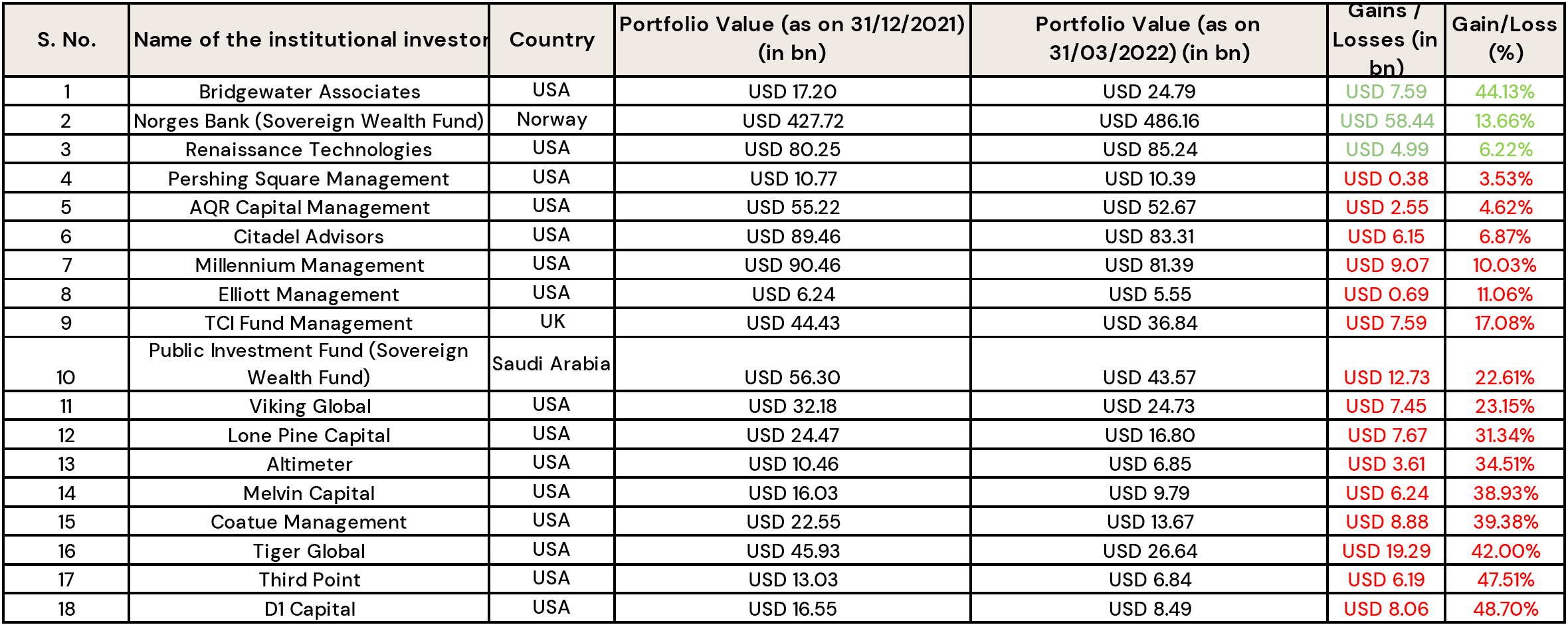

Investors too focused on the growth style of investing saw much of their gains get erased in the recent market downturn. Some of the world’s biggest investors were forced to book big losses because of the uncertainty surrounding the interest rate decisions by central banks around the world.

And investors who had higher exposure to value stocks over the past few years, couldn’t participate in the huge run-up in the valuations of most of the technology companies.

How should we position our portfolios?

While investors can have their view on where the economy is headed and can accordingly position their portfolios to match that – we feel that it is best if the exposure to these individual styles of investing is limited to the ‘Satellite’ portion of the portfolio. This ensures that the portfolios are well-diversified across different market cycles and not over-exposed to any single macroeconomic factor.

Our DMAS portfolios follow the time-tested approach of investing and are constructed in a manner that gives investors adequate exposure to both these styles. Speak to one of our wealth experts if you’d like us to customize a portfolio for you.